Free trade

|

|

Free trade is the unhindered flow of goods and services between countries, and is a name given to economic policies and parties supporting increases in such trade.

The relative costs, benefits and beneficiaries of free trade are debated by academics, economists, governments and interest groups. Aspects of the ongoing debate are addressed below.

Wider meaning of "Free Trade"

Free trade is a concept in economics and government that can refer to:

- international trade of goods without tariffs or other trade barriers

- international trade in services without tariffs or other trade barriers

- the free movement of labor between countries

- the free movement of capital between countries

- the absence of trade distorting policies (such as taxes, subsidies, regulations or laws) that give domestic firms, households or factors of production an advantage over foreign ones.

Depending on the specific context, use of the term free trade can signify one or more of the above conditions. In almost all cases, violations of the free trade conditions are due to government-imposed policies.

The term free trade has become very politically loaded, and it is not uncommon for so-called "free trade agreements" to impose additional trade restrictions. Such restrictions on trade are often due to domestic political pressure by powerful corporate, environmental or labor interest groups.

Free trade agreements are a key element of customs unions and free trade areas. The details and differences of these agreements are covered in their respective articles.

When free-exchange is not Free Trade

The World Trade Organization was created to open up markets, and promote international trade based on the laissez faire 'Free Trade' paradigm. The WTO creates and monitors agreements to reduce trade barriers, and arbitrates in disputes over foreign market access, and violations of these agreements. Its definition of 'Free Trade' is trade On a level playing-field, so that the unlimited exchange of goods between countries is not necessarily 'Free'. If one of the countries producing Aircraft, say, subsidizes corporate R&D or enacts local-procurement regulations the WTO considers this a violation of Free Trade, even when the barriers to trade are not imposed at the national borders in an import-export transaction step (like a Tariff).

Totally Free Trade

Some economists (especially Libertarians) criticize the WTOs definition of 'Free Trade' as too narrow. They argue that a foreign Governmental producer-subsidy is another form of 'comparative advantage' and should not be used as a reason to impose domestic barriers on the purchase of overseas goods.

These economists argue that (since the surplus benefit to domestic consumers outweighs the surplus loss of domestic producers) the lower price of foreign subsidized goods is a net positive (as in the standard Ricardian argument) and the source of the 'comparative advantage' is irrelevant. Therefore, any import restriction (even on 'dumped goods') makes the domestic society as a whole worse off than it would be with unlimited imports (they say).

This 'abolitionist' position has had little governmental support in the developed world, due to the following considerations:

- Producer interests (and jobs) are more organized than consumer interests

- The 'artificial' handicap of a foreign subsidy seems much less 'just' to local production than advantages deriving from geography, natural resources, or native skill. Electorates often prefer "fairplay" to Utilitarian considerations.

- Despite accepting that a country would be better off without Tariffs than with them, some Game Theory models suggest a superior strategy to immediately dropping all Tariffs; if progressively dropping barriers bilaterally can be used to open foreign markets to domestic suppliers this is a superior long-term strategy. In this model, Tariffs are a negotiating tool with which to pry open foreign markets for domestic goods, benefiting both domestic consumers and domestic producers. (The justification for tariffs is not important; Tariffs only exist in order to be relinquished.)

- If trade barriers are already low, the threat of a "Trade war" of tit-for-tat tariff increases may reduce the temptation for either partner in bilateral trade to raise import barriers.

History of free trade

Main article: History of free trade

All currently developed countries have attained their position with the substantial use of protectionism, up until the moment that they gained sufficient economic superiority to guarantee that they would benefit from freer trade. As economist Dani Rodrik notes, "the only systematic relationship [between tariffs and economic growth] is that countries dismantle trade restrictions as they get richer."p22 (http://www.undp.org/poverty/docs/pov_globalgovernancetrade_pub.pdf) Even the first country to develop - Britain - promoted its leading industry (the manufacture of woollen textiles) by taxing exports of raw wool and trying to attract foreign workers to undermine the competition. In the 1700s to mid-1800s, it used trade and industrial policies similar to those later used by Japan and South Korea. Once Britain had secured economic leadership in the mid-nineteenth century, it began to champion free trade. Criticising the British preaching of free trade, Ulysses S. Grant, US President 1868-1876, retorted that "within 200 years, when America has gotten out of protection all that it can offer, it too will adopt free trade".[1] (http://homepage.newschool.edu/~AShaikh/globalizationmyths.pdf) Indeed, only at the end of World War II did the US, previously one of the most heavily protectionist countries in the world, begin to champion free trade in the way that Britain had, leading to GATT(1947), the WTO(1995) as well as regional trade agreements such as NAFTA(1994).

Arguments for free trade

In the history of free trade, two types of argument have been advanced in favour of allowing purchases from abroad, and "Free trade" in the broader sense. The first set of arguments are essentially economic, that free trade will make society richer (more propsperous in money terms). These are mostly technical arguments from the discipline of economics, starting especially with Smith's "Wealth of Nations", which overthrew the mercantile orthodoxy. The other set of arguments for free trade could be classified as "moral" arguments, which are pitched at a more high-minded level, some of these are listed below.

Economic arguments for free trade

Classical economic analysis indicates that free trade increases the global level of output (thus, increasing the global standard of living) because free trade permits specialization among countries. Specialization allows nations to devote their scarce resources to the production of the particular goods and services for which that nation has a comparative advantage. The benefits of specialization, coupled with economies of scale, increase the global production possibility frontier. An increase in the global production possibility frontier indicates that the absolute quantity of goods and services produced is highest under free trade.

Further classical analysis shows that not only are the absolute quantity of goods and services higher, but the particular combination of goods and services actually produced will yield the highest possible utility to global consumers.

Qualitative Arguments

Free trade policies are often associated with general laissez faire economic policies, which can allow for faster growth. Laissez faire policies—the absence of government intervention in trade, entrepreneurship and investment—is often positively correlated with high per capita income. Economic Freedom and Per Capita Income (http://www.heritage.org/research/features/index/downloads/economicFreedomandPerCapita.gif)

A Graphical Illustration of Production Possibilities

Here is the production possibilities frontier for a fictional country, Country A. For simplicity, assume that the country produces only two goods, meat and rice. Because the country has limited resources, the production of an additional unit of rice means some resources must be diverted away from the production of meat. The particular rate of trade-off between meat and rice is not important for this analysis, so it can be ignored.

Free_trade_country_b.gif

Country B

Here is the production possibilities frontier for a second fictional country, Country B. Again; the country can produce only the same two goods, meat and rice. Like before, limited resources mean that the production of an additional unit of rice means some resources must be diverted away from the production of meat. The particular rate of trade-off between meat and rice is not important for this analysis, so it can be ignored. The fact that the two countries have different relative rates of trade-off is important. This difference gives rise to a comparative advantage, a key concept in economics. Even if one country has an absolute advantage in the production of all goods, both nations can benefit from trade due to comparative advantage.

Free_trade_world.gif

World

The first two images above assume a state of autarky, which means no trade occurs between the two countries. If free trade is possible, the green line is the production possibilities frontier for the entire world. The world PPF is made up by combining the two countries' PPFs. Linear PPFs will always combine to form a shape with an inflection point, as shown at right.

Compare the world's production possibilities frontier with each individual nation's. Clearly, the world can produce and consume more when free trade is allowed. To arrive at the world's production possibilities frontier, vector addition must be used. Country A and Country B's meat and rice outputs must be added together for each possible production point.

Free_trade_world_composition.gif

World

An intuitive way of arriving at the world's production possibilities frontier is to first assume that each country tries to specialize by producing only one product. In the graph at right, the first units of meat are produced only by country B (red). Once country B is using all its resources to produce meat, then country A (blue) begins shifting resources away from the production of rice and into the production of meat. On the other axis, assume that the first units of rice are always produced by country A. Additional units of rice can only be obtained if country B shifts some resources into rice production.

Free_trade_country_a_eqm.gif

Country A

Returning back to country A, here is the same production possibilities graph, now with indifference curves added in. Indifference curves are a measure of preference and utility. Interplay between the country's preferences and production result in the actual combination of goods produced and consumed. Remember, this is the state of Country A under autarky.

Free_trade_country_b_eqm.gif

Country B

Here is the same view of Country B's economy. Again, the actual combination of goods produced and consumed is dependent on the country's productive abilities and its citizens' preferences. Thus, it is not surprising that the combination of goods consumed in Country B differs from that in Country A.

Free_trade_world_eqm.gif

World

Graphical information of the two countries can be combined in a single graph, as shown here.

Free_trade_world_eqm_comp.gif

World

When the two countries' autarkic consumptions are added, the total quantity of each good produced/consumed is less than the world's PPF under free trade. This indicates that by trading, the absolute quantity of goods available for consumption is higher than the quantity available under autarky.

A Graphical Argument Against Tariffs

The following pro-Free Trade argument in neo-classical economics looks at the changes of consumer surplus and domestic-producer surplus caused by increased imports when tariffs are removed.

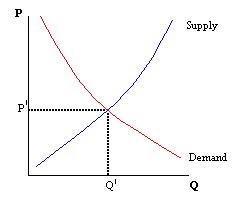

With a tariff in place the domestic price of a good is at P1 and the quantity produced in the country is at Q1.

- Figure 1 illustrates this initial level as goods market equilibrium

Freetrade2.jpg

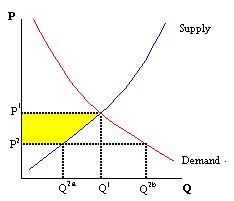

Due to a Tariff, the good's price on the international market is lower than the domestic price.

- Internationally the price is P2.

(These prices on the international market have been converted into local currency.)

- Figure 2 describes the effect on price and domestic production of removing the tariff and allowing free trade. If the tariff is removed the domestic price of the good falls to meet the international one, since rational consumers will buy at the cheaper, foreign rate until competition lowers the domestic price to reach it.

At the lower price fewer domestic manufacturers would wish to make the good, thus the quantity produced domestically falls to Q2A. However, at the new lower price far more consumers would be able to buy the good, and thus quantity of the good purchased would increase to Q2B, with the difference between Q2A and Q2B being imported.

Since less of the good is being made in the country producer surplus will shrink. Companies will either be forced to reduce production, or some of them will have to close.

If we assume that the total domestic consumption was supplied by domestic producers while the Tariff was in place, the drop in domestic production is Q2A - Q1.

- Figure 3 shows the amount producer surplus will decrease under the assumption of no imports with a high initial tariff.

In fact, this isolationist tariff is the worst-case scenario for domestic producer surplus loss. Typically, some of the domestic consumption would have been imported, even with tariffs in place, and therefore some of the surplus loss to producers would fall on imports. Although the domestic society would also be hurt by reduced tariff revenue, some of the net loss to producers would still occur overseas. (Smuggling and the positive slope of the foreign supply curve mean that any surplus gained from imports pre-tariff-repeal by foreign producers would be greater than the tariff paid.) Therefore, the resulting drop in domestic producer surplus depicted is greater than the fall that would actually occur, assuming some imports.

Therefore, the yellow area is the maximum domestic producer surplus loss.

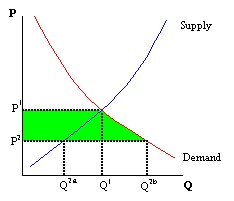

- Figure 4: Benefit to the consumer from price deflation

The lower price will increase consumer surplus. More consumers would be able to own the good in question and their standard of living will increase. Everyone who buys the good domestically is now better off.

- The green area gives the surplus-gain to consumers

Freetrade5.jpg

- Figure 5: Comparing producer surplus and consumer surplus.

The increase in consumer surplus will be larger than the decrease in producer surplus.

Taking the yellow producer surplus-loss from the green consumer surplus-gain gives the red net-surplus-gain across society caused by removing the tariff.

This Utilitarian argument claims that society should maximize total utility, and that removing tariffs will lead to the net utility increase highlighted in red. However, different constituencies suffer (domestic producers) from those who benefit (domestic consumers) in tariff repeal. Some people reject the utilitarian calculation on the basis that utility changes cannot be compared between groups. It has also been argued, on less theoretical grounds, that a change which is not Pareto optimal, and hurts some groups (such as producers) should be rejected a priori. To overcome this objection the outline argument can be modified to include transfer payments from consumers to producers to make everyone better off as trade barriers fall.3.

It has often been observed that the changes in surplus between consumer and producer do not directly correlate into political action. Since producers are smaller in number and more organized than consumers they form a more effective lobby against the lowering of tariffs than consumers do. Template:Ref

This graphical argument assumes full employment; that the workers who lose jobs because of the decrease in the amount produced will find jobs in other industries that can better compete internationally. It also assumes that trading regions are world price-takers; that no matter how much is imported, the world price remains constant (this is reasonable for regions that are sufficiently small).

Reciprocal free trade is in exporter's interests

An early lobbying effort on behalf of free trade was made by the businessmen of the Anti-Corn Law League. Some of these gentlemen owned textile factories, and believed that repeal of the Corn Law import-ban would allow 1830s Britain to sell cotton clothing to wheat-exporting nations.

Although this argument is rooted in Mercantilism and producer self-interest it amounts to a voice in favour of free trade. See also: Reciprocal Trade Agreements Act.

In 1950 Jacob Viner showed that a trading block mutually lowering tarrifs would produce gains not merely on the demand side but also on the supply side. This was called trade creation, the benefits to the supply side as a whole accrue as resources are reallocated towards firms producing at the highest comparative advantage (among the partners) in each country.

Moral arguments in favour of free trade

The 18th and 19th century intellectuals who backed free trade rarely did so under the the rubric of increasing material wealth. In many cases this was given as the least important reason for free trade. Rather, they argued that international society would be improved by increased commerce. Some of these, and later, sociopolitical arguments are listed here.

Claim: Increased commerce means reduced war

The argument for free trade that commonly underlies neoliberal foreign policies can be made from the perspective of national security - it is seen by some policy analysts that countries that trade with each other are less likely to go to war due to the enormous cost of suddenly disrupting their trade abroad, particularly since they would be dependent on the world economy as a result of specialization and comparative advantage.

Qualitative analysis suggests that free trade encourages economic interdependence between countries, reducing the likelihood of war. However, the belief that free trade would reduce war was hypothetical rather than empirical (at least until the 1950s). Twenty-two years after Ricardo advanced his theories of comparative advantage they were used as justification by the British to start the Opium wars. Also, it is hard to know when the occurrence of free trade has prevented the outbreak of war, but easy to know when it hasn't; critics of free trade sometimes cite the First World War as an instance where developed, industrialized countries with reasonably extensive trade links abruptly broke off those trade links and entered into a particularly destructive war. It is an open question whether the First World War, its causes, and the economic environment that preceded it are sufficiently similar to the modern globalized economy to draw parallels between 1914 and 2005.

The fact that some wars have been fought between trading-partners does not disprove the notion that increased trade lowers the willingness to go to war, simply that however much it does so, other considerations sometimes overwhelm the economic. McDonald's is in the vanguard of global free trade, permitted to spread its brand of consumerism by the free trade in capital (its product is mostly sourced locally). Famously, only a single, short, war has been fought between any of the 122 countries having franchises. This fact might not be due to the ties of trade, but could still be attributed to the homogenizing effects of free trade, as identical consumers the world over see less reason to wage war on one another.

After the second world war many liberals said that the war's ultimate cause had been the restrictive trade practices of Nazi Germany and the British Empire. They thought that free trade would increase the likelihood of a lasting peace. Cordell Hull, the U.S. secretary of state until 1944, believed this, and argued that as trade barriers dovetail with war, so free trade does with peace. The post war consensus expressed at Bretton Woods was that government coordination was necessary to prevent trade wars and competitive devaluations, to ensure free trade and peace.

Trade broadens the mind

The quality and variety of produce available from international trade is much greater than the range that could ever be domestically produced in a single country. The wealthy always had access to such luxuries, but before free trade the experiences available to the average person were dramatically limited. (For example, the history of tourism or the Spice trade).

Critique: Tariffs sully the cause of patriotism

Adam Smith thought that all protectionist measures against free trade were scams on the public on behalf of producers, carried out in the name of nationalism. Even if the national economic interest had not been harmed by tariffs, he was opposed to them on the grounds that patriotism shouldn't be perverted by scoundrels to enrich themselves.

Tariffs are internally divisive

If producers are located in different parts of the country than consumers then price-raising tariffs will cause social distress in one region, and wealth in another. This was the cause of the U.S. Nullification crisis.

Does government have the moral right to restrain trade?

The modern libertarian position simply argues that any trade restraint is immoral a priori, since restricting the rights of sovereign consumers to purchase foreign-made goods is outside the competence of legitimate government. This is in the tradition of the anti-Corn Law radicals, like Richard Cobden, who concluded their 1838 parliamentary petition with an appeal to "negative liberty":

- "Holding one of the principles of eternal justice to be inalienable right of every man freely to exchange the result of his labour for the productions of other people, and maintaining the practice of protecting one part of the community at the expense of all other classes to be unsound and unjustifiable, your petitioners earnestly implore your honourable House to repeal all laws relating to the importation of foreign corn and other foreign articles of subsistence, and to carry out to the fullest extent, both as affects agriculture and manufactures, the true and peaceful principles of Free Trade, by removing all existing obstacles to the unrestricted employment of industry and capital." Template:Ref

Claim: free trade reduces poverty

Conflating the "moral" and "economic" arguments are those campaigners who say that increased trade is the best way to relieve extreme poverty throughout the world. Opposing free trade, they argue, is tantamount to supporting economic injustice. (For instance, "The Economist" magazine sometimes runs controversial cover stories making this impassioned argument for free trade.)

The thrust of this point is that economic and moral issues cannot properly be separated, and that any other particular socioeconomic problems can be combated most effectively through rising living standards.

Bjørn Lomborg's Copenhagen Consensus on international development challenges ranked trade liberalization as third on the list of development priorities; the experts judged that modest costs could yield large benefits for developing nations. (They ranked freer trade as a "Very Good" opportunity for fighting misery along with cheap measures against HIV infection, micronutrient distribution, and anti-malarial programs.) The conference was of the opinion that reducing subsidies and tariffs would improve the wellbeing of the global poor being more than any agricultural, political, or environmental program. They considered that the free trade in labour would also be a significant (although less important) move against poverty, especially if skilled worker migration were permitted. The approach and conclusions of the "consensus" have been widely criticized, especially trade liberalization's high ranking.

The critics of "free trade"

This section lists some of the many modern critiques of free trade and its effects. Opponents of free trade often advocate an alternative policy known as fair trade: see that article for a detailed treatment. One important point in "fair trade theory" is that modern advocates for the poor are not typically against "free trade", they actually want more of it. For instance, the Indian government had an isolationist policy of economic independence, especially between the 1950s & 1980s, but, along with the governments of many developing nations, opted to reverse this and lobby for access to export markets (at firstly tentatively, but then decisively in the early 1990s under Manmohan Singh.) Therefore, much of the modern dispute over "free trade" is semantic; the official US interpretation of "free trade" is dramatically opposed to the Vietnamese interpretation (on the subject of catfish), but both governments are in favour of "free trade".

Arguments against free trade typically take one of two sorts: economic and sociopolitical. Economic arguments against free trade critique the assumptions or conclusions of the economic theories that support it. Sociopolitical arguments against free trade do not attack the mathematical and theoretical salience of free trade theory, but rather cite social and political effects that economics-based free trade arguments do not capture, such as social stability, political stability, cultural independence, and national security. Many sociopolitical critics of completely free trade support the economic conclusions of liberal trade policy in general, but are against it in specific cases.

Economic arguments against free trade

Free trade in raw materials retrogrades development

The argument that a country could get 'locked in' to serving the needs of the world market in raw materials, and therefore not develop industrially was first advanced by Friedrich List in 1841, and received empirical support in the 20th century. It was discovered that African and Arab nations rich in natural resources (e.g. diamonds and oil) developed less slowly than those nations without such 'bounty'. This is also a sociopolitical argument against free trade, because it is said that:

- The regimes exporting such valuable commodities to the west tended to be autocratic, and remain in unpopular power because of the massive payment streams from exports.

- The reason that civil wars and violence are correlated with the discovery of mineral wealth in the developing world is the world market for the commodities. This is one area of free trade which has few supporters, and conflict diamonds cannot be openly imported into any country.

It was also discovered that developed nations uncovering natural resources could suffer as a result of free trade, and for similar reasons. The massive capital influx to Holland after it started exporting oil increased prices in the famous "Dutch disease".

Free trade between countries means the unhindered flow of goods and services between them, and is a name given to economic policies and parties supporting increases in such trade.

The relative costs, benefits and beneficiaries of free trade are debated by academics, economists, governments and interest groups. Aspects of the ongoing debate are addressed below.

International trade requires more resources to distribute

If food is purchased from the local farm it requires very little energy and possible no fuel to transport to the table. Delivering food produced on the other side of the world to a supermarket has an environmental impact because it requires a heavier use of fossil fuel in delivery from overseas. The organic food movement claims that there are other downsides to the globalization of the food market (for instance, that preserved food has an inferior taste).

Deep Green thinkers say that Free Trade claims to lead to the "full employment of resources", and strongly oppose Free Trade in the hope of discouraging the immediate depletion of the earths resources.

Sheltering young industries may pay-off later

Main article: Infant industry argument

New Trade theorists challenge the assumption of diminishing returns to scale, and some argue that using protectionist measures to build up a huge industrial base in certain industries will then allow those sectors to dominate the world market. Less quantative forms of this "infant industry argument" against totally free trade have been advanced by trade theorists since at least 1848.

Modern free trade inequitably favours rich countries

Many anti-globalization campaigners argue that free trade allows developed nations to exploit developing nations and to destroy local industry.

The current implementation of free trade has been criticized by advocates of free trade itself (e.g. The Economist). One complaint is that developed nations tend to insist that developing nations open their markets to industrial and agricultural products from the developed world, yet refuse to open their markets to agricultural goods from the developing world. A prevalent line of reasoning against free trade is that trade barriers such as quotas and agricultural subsidies prevents farmers in the third world from competing in local and export markets. It is argued that this limits the ability of third world countries to develop.

The current concept of "free trade" supports the free movement of products and employers, but not the free movement of employees (i.e., labor - See also: Immigration.) This interpretation of "free trade" offers much greater freedom to people in developed countries than it does to people in the developing world. (The rich own most of the global corporations, and buy most of the traded products. The main asset of the poor is their labour, which they are unable to trade "freely".)

In the modern knowledge economy the goods and services 'exported' by developed nations are often intangible designs (such as 'medicinal formulae', 'trademarks', 'software', or entertainment content). The value of this Intellectual property (IP) is largely derived from the legal protection it enjoys from copying. Many advocates for the poor claim that the reason IP-rights are strongly protected in International trade is the economic power the developed world uses to protect the interests of their IP producers during trade negotiations. This is an especially emotive argument when applied in areas like AIDS medicine; WTO-signatory nations renounce the right to produce generic copies of life-saving pills, the only treatment widely affordable in developing nations.

A variation on this is the claim that free trade benefits wealthy people more than poor people within countries, because:

- The wealthy own more corporate equity, which increases in value as companies are able to produce at the lowest cost anywhere in the world.

- As the world's markets merge into a single "global market" the number of market-leading companies worldwide drops, with international take-overs of local champions by giant corporations such as Wal-mart. This process concentrates success, wealth and power in the hands of fewer and fewer business leaders.

- Across the world, the poor tend to do the lowest skilled work, and free trade is said to replace low-skilled employment more easily than high-skilled. This implication of the advanced-Stolper-Samuelson theorem is challenged by free trade's allies and critics alike, on the basis that modern technology makes offshoring high value-added work feasible, and more profitable than moving entry-level jobs.

Free Trade increases outsourcing opportunities

Free trade allows companies the possibility of outsourcing the production of goods for domestic sale. The social, environmental, and labour standards imposed upon these companies can be less in foreign production than in domestic. Labour and environment advocates argue that Free Trade thereby creates the conditions that allow companies to circumvent domestic regulations, by producing in another jurisdiction. As free trade increases, the balance of power shifts in favour of companies and away from governments. This is widely accepted, and considered to pose a threat to democratic self-determination by anti-globalizers (and authoritarian control by totalitarian states). Free trade supporters argue firstly, that all countries have the right to opt out of the world market through isolationism, and secondly that companies are fictional persons who are taxed without representation, and that the balance of power should shift away from the governments that exploit them. It has also been argued that free trade hurts developed nations because it causes jobs from those nations to move to other countries, and accelerates the "race to the bottom". As well as reducing rich-country GDP through lost jobs, the argument goes that competitive pressures will undermine democracy by creating external pressures to lower wage demands, and legal protections like environmental and safety standards. The alleged "race to the bottom" is blamed on international competition to attract traded-goods production, which, with Free Trade, can be sited anywhere.

Free market supporters have called some of these arguments a "Lump of work fallacy".

The "Capital Mobility" Free Trade critique

Some descriptions of comparative advantage rest on a necessary condition of "capital immobility." If financial (or labor) resources can move between countries, then the comparative advantage theory erodes, and absolute advantage dominates. (For instance, the Heckscher-Ohlin model derives comparative advantage from differing relative abundances of capital & labour between countries. Capital mobility and the competitive drive for the highest return on investment would give all countries identical relative abundances for new investment, eliminating comparative advantage and trade.)

Given the liberalization of capital flows under free trade agreements of the 1990s, the condition of capital immobility no longer holds. David Korten and other economists argue that the theory of comparative advantage "is replaced by that of downward levelling". However, capital immobility is only one route to comparative advantage, useful to simple economic models, in order to make quantative predictions, but not underlying it.

Early theoretical models assuming capital immobility were merely an expositional convenience that is not essential to the principle. Although greater capital mobility is likely to reduce comparative advantage, barriers to capital flow are not the only way to derive it; the following comparative advantages will still exist with complete capital mobility:

- Early, qualitative, descriptions of the principle were based on the greater ease of producing different commodities in one country rather than another, and not on capital mobility. The comparative advantage of France over Iceland in wine production is not based on capital immobility.

- As economist Paul Krugman has noted, the 19th century economic theorist David Ricardo who formulated the well-known simple model of the comparative advantage doctrine lived himself in a period of high capital mobility. His ideas were based on different production functions in different goods (differing 'technologies') internationally; these do not necessarily require capital immobility.

- Comparative advantage can be derived from more complicated modern models including capital mobility (i.e. international borrowing, lending, and labor movement) and often posit movement of capital as analogous to the movement of goods.

Sociopolitical arguments against free trade

Free trade is culturally destructive

The French government argues that allowing Hollywood movies to compete un-handicapped against French-made films would be culturally destructive. Free Trade in cultural work is limited on the grounds that otherwise, the French language, and the visibility of a particularly "French" perspective on the world would be threatened. Many other countries have advanced similar arguments against the free trade of cultural works (such as the US itself, in the import of certain censored work from Europe).

The French take a similar line on food imports: the import of agricultural produce competing with Gallic farmers is limited on the grounds that high food market prices are necessary to sustain rural France. This is seen as critical to preserving the national culture. As a relatively wealthy country, France is able to afford the cost of protecting its small farmers; most developing nations are not in the same position. Throughout the world, forces that many blame on free trade are eroding traditional ways of living and rural cultures. Critics of globalization see this as a much bigger problem than is accounted for by advocates of the free market. For instance, Sir James Goldsmith attacked free trade for causing the conversion of small-scale agriculture to large-scale agribusinesses across the developing world. He wrote:

- " The loss of rural employment and migration from the countryside to the cities causes a fundamental and irreversible shift. It has contributed throughout the world to the destabilization of rural society and to the growth of vast urban concentrations. In the urban slums congregate uprooted individuals whose families have been splintered, whose cultural traditions have been extinguished and who have been reduced to dependence on welfare from the state." Template:Ref

In Canada many cultural nationalists argue that the North American Free Trade Agreement or any proposed extension could harm Canadian cultural content, mainly due to the fact that U.S. corporations (mainly magazines, television channels, and satellite providers) have been consistently challenging Canada's cultural content laws. These laws are popular among Canadians and encourage Canadian content in the Canadian media, something which foreign (mostly American) corporations charge is harmful to their businesses.

Free Trade causes social dislocations and emotional pain

Some suggest that free trade changes living conditions and careers too fast. Economic disruptions from "structural adjustment" once happened slowly enough that natural attrition (deaths and retirement from existing jobs) took care of the shift into new patterns of employment. At one time, a farmer could expect to finish her life as a farmer, although her children may have been forced to take up mining or manufacturing instead of farming. Now, changes happen on a sub-generation level, quicker than a natural-attrition rate.

Coping with these transitions can be very difficult, especially for those entering middle-age and the elderly, who tend to have a more difficult time making career changes, either due to age itself or age-related discrimination. The problems associated with adapting to economic change are generally not factored into the economic calculation of Free Trade's effects. (In economist's jargon these issues are "externalities", not factored into the calculations, such as: "A Graphical Argument Against Tariffs" above. Minimizing the average price of widgets is not necessarily the same as minimizing emotional disruptions.)

Welfare economics deals with the question of the overall benefit on society of changes that harm some and help others. In a straightforward, utilitarian view; the generalized benefits of cheaper supply are given equal weight with the more concentrated impact of lost jobs in the labour market. Many economists have argued that this is the wrong scale to use, and that the harmful effects of greater Free Trade on some should be given much greater weight than its benefits for all (for instance, the test of Pareto optimality).

Dependency

Criticisms of imperialism sometimes focused on the way that imperial powers gained influence over weaker countries through specialization; weaker countries would develop areas, typically in resource extraction and agriculture, that would be economically dependent on the mother country. In the post-imperial world, this criticism changed somewhat; a few industrialized powers that controlled capital flows could, according to dependency theory, maintain their preferable economic status vis-a-vis their former colonies by using this economic dependency to their advantage. In theory, industrialized powers would have far greater choice - a more perfectly competitive market - in countries from which they could acquire basic resources than those countries would have in buying industrialized goods, particularly as industrialized countries had the bulk of the world's financial resources and if those industrialized countries chose to behave oligopolistically. Such a pattern of exploitation - which may or may not lead to the benefit of even the industrialized nations, depending on the economic theory applied - focuses on the unique importance of political power in the international system and its particular weight in the decisions of policymakers.

The theory was popular during the Cold War in developing countries, particularly after the retreat of European empires from Africa and Asia. The citizens and policymakers of developing countries remembered the economic patterns of the imperial age and there was a strain of anti-colonial sentiment in many newly independent nations who sought national sovereignty for its own sake. Dependency theory was also popular in Latin America, which, although having been independent from its colonial rulers since the early nineteenth century, had in succeeding decades been often influenced by the economic interests of foreign countries, particularly France, the United Kingdom, and the United States.

National security

The debate over the Corn Laws (grain tariffs) in the United Kingdom in the early nineteenth century provided one of the earliest instances of a principled, economically-based national debate over free trade. One of the chief arguments of the protectors of the Corn Laws was national security; Britain, they said, ought not be dependent on the import of grain to her country, or else she risked putting her national security in the hands of foreign countries. Countries upon whom Britain was dependent for grain could starve her even without instituting a blockade. This national security argument, the argument of David Ricardo's time, focused on the ability of free trade to threaten the sovereignty of a nation at war, while the dependency theory a century later would focus on the ability of free trade to threaten the sovereignty of a nation at peace.

To some extent, the Corn Laws' ultimate repeal refuted the dependency argument; because it was seen that a country (Ireland) might suffer more from total reliance on its own crop (the potato) than from the theoretical danger of dependence on foreign suppliers.

In fact, the security argument had always been questioned on the grounds that every market in the entire world would have to stop selling at any price for an importer to find itself imperiled, unless a blockade were used. It was said that any nation (especially England) unable to defeat a blockade couldn't hope to win a 19th century war anyway. Although wars were subsequently fought over access to markets these have always been markets in commodities not domestically available (principally oil; see also Raw materials causes of Japanese expansionism.) In the history of the world, no country has ever suffered military defeat, or capitulated to sanctions, due to the inability to produce a domestically producible product.

In the modern United States and in many developed Western countries, one of the chief arguments in favor of farm subsidies is a national security argument. The threats of bioterrorism and even unintended disease-causing agents has raised the possibility of poorly inspected food entering a country from another, presumably with less stringent food inspections. Like a number arguments against free trade, this argument rests on the inequity of government regulations across countries the world over, although some critics of the US food industry point out that the same argument is used whether or not the standards imposed actually are higher or lower abroad. (See: Fast Food Nation.)

The advance of technology in the twentieth century has provided another source of anxiety about free trade. Trade in high-tech equipment can facilitate the implementation of advanced military technology in countries that may become strategic opponents later on. This argument is often compelling to policymakers in developed countries, and free trade rarely applies to military technology, and often special restrictions are placed even on advanced technology developed in the nonmilitary sector.

A final argument from national security is similar to the previous; if free trade encourages the development of a world market that equilibrates wages, industrialization, and productivity per laborer, this can amount to the armament of strategic opponents. This argument is often brought up in the context of United States-China trade relations; if the Chinese economy were to develop the same production per capita as the United States, China would be able to harness economic resources four-fold what the United States economy could, and, in theory, proportional military resources. Although this concern is widespread within the United States, the desire to keep a potential rival weak is not normally advanced within diplomatic circles.

Free trade creates dangerously porous borders

Terrorism in the broader sense frequently benefits from porous borders. Another common national security argument against free trade - this one often brought up in the context of the United States-Mexico border and the trading links between Europe and the Middle East and North Africa - points to the tendency of liberalized trade to encourage such porous borders. The radically increased volume of trade that passes over a given border can swamp border controls that were once sufficient before the implementation of freer trade. Even with sufficient border controls, it is considered that the cost of such border controls, both to the government and traders having to endure the time and expense of passing through them, could be prohibitive to trade.

Concern about uncontrolled immigration in the wake of free trade, and about legal immigration itself within trading blocks have added anti-immigration campaigners (not all of whom are xenophobic) to the lobby against free trade.

Rule of law and regulations

Although in David Ricardo's time economists regarded the regulatory powers of the state as being more destructive than beneficial, the economic shocks of the later nineteenth century, the early twentieth century and the Great Depression produced a strain of economists led by John Maynard Keynes who criticized laissez-faire capitalism as itself destructive. After the war these Keynesians assisted the state in the development of regulatory institutions that limited the excesses and mitigated the failures of the free market and which were intended to sustain free trade through regulation. The later twentieth century saw the development of new economic theories that criticized the stress on regulatory institutions, though it is an uncommon opinion even among modern neoclassical economists to wholly regard all such regulatory functions of state as damaging to the economy.

These regulatory institutions, and indeed the rule of law itself, are costs to the development of industries. Although a number of laws - the protection of property rights, for instance - are strongly beneficial to corporations interested in the development of an industry in a foreign country, many other laws, regulatory laws in particular, can produce litigation risks or greatly increase the cost of operating in that country. Environmental regulations, labor laws, minimum wages, safety regulations, and (arguably) basic human rights can effectively increase the cost of operating in a country. As a result, these regulations often lead to a competitive disadvantage in the world economy for countries implementing those laws.

Similar arguments can be made for tax laws; corporations can evade high taxes by moving operations to countries with lax tax structures. In countries where the integrity of the state is weak, there can be an incentive for corporations to subvert governments through corrupt means and further undermine the rule of law in those countries in their favor. Accounting, banking, and investment regulations can take a similar direction; countries very interested in attracting investment may laxen their financial institutions for short term political benefits. Some economists, such as Frederic Mishkin, point to this as an underlying cause of the Asian economic crisis of 1997-1998.

Many developing countries have not developed the financial institutions that developed countries rely on for the efficient functioning of their economies. The financial institutions that do exist in developing countries are often designed for economies with a strong role built for the state, and often with a great deal of corruption already existing. The influx of large amounts of investment capital from developed countries can put a considerable strain on financial institutions as they cope with enlarging their regulatory role, separating it from old state functions. The capital influx creates lucrative opportunities for corruption, especially within the regulating institutions. The development of these institutions runs a difficult course with investors who are interested both in the rule of law as it improves investment opportunities, and also in limiting their risk as investors. The development of these institutions can be a low priority for a poor county, which must bear the cost of modifying its business code, essentially for the benefit of foreign capitalists.

Free trade, then, creates an economic incentive for a race to the bottom in regulatory institutions; countries with lax, lenient, non-enforced, or selectively enforced regulatory legal structures will have a competitive advantage in attracting investment to their countries, and not merely in wages. From the capitalist's point of view, an ideal legal environment would have these features:

- Weak or un-enforced labour and environmental protection laws.

- Low or uncollected taxes.

- Strong legal protection for property rights.

- Changes to the legal code should be few and predictable, allowing business planning. The government should not be likely to override the rule of law, or impose exchange controls.

The difficulty that modern capital finds in meeting all of these conditions is that (1) and (2) are correlated with an immature legal system, but (3) and (4) are correlated with the division of powers, and long-standing legal institutions. As Russian oligarchs and early foreign direct investors in China discovered, the ability of an enterprise to make money is no guarantee that its profits can be retained. Some have argued that firms actually encourage (or at least prefer) the rule of law, judging that, on balance, it is "good for business". If so, the "Race to the bottom" may become a "Race to the middle" in legal enforcement, assisted by mobile capital, in order to create the optimum legal conditions for investment (balancing legal protections for labour and capital).

In theory, globally harmonized regulations regarding wages, the environment, safety, human rights, and other areas of economic control, would also prevent a "race to the bottom." Although globally harmonized regulations appear to be far off, there have been a number of moves toward regional agreements about these sorts of institutions.

The financial consequences of mobile capital

The diversity of legal systems the world over and the limited degree to which those bureaucracies coordinate their regulatory and tax-collecting efforts can create loopholes to the benefit of corporations and private individuals, who can seek out havens from regulation and tax collection, even if they obey the letter of the law.

The freedom of capital to move outside the purview of a single authority has other harmful effects, even where it is not invested in the real economy. The following are common abuses of the free trade in capital:

- Tax avoidance (legal)

- Money laundering (illegal)

- Obfuscation of corporate accounts (possibly legal)

One of the chief concerns among modern economists and financiers is to develop methods of harmonizing international regulatory institutions, in particular accounting practices, to improve transparency in world financial markets and reduce the risk experienced by investors.

Stability

Free trade and comparative advantage imply the development of specialized industries and profound economic change in countries that commit to such programs. Even apart from cultural concerns, these economic changes can lead to profound strains on societies that face considerable changes to traditional economic patterns, orthodoxies, and political systems. Social changes that Europe passed through over the course of centuries - urbanization, the development of national infrastructure, the development of individual property rights, secular and national government, centralized administration, the development of financial sectors, and far-reaching regulatory structures - can happen over the course of mere years in an economy newly exposed to free trade and capital flows.

Even the fundamental aspects of free trade and free capital flows - usury and property rights - can come into conflict with existing systems. Stipulations against usury remain strong particularly among conservative interest groups in parts of the Islamic world (see Islamic banking) and the development of Western-styled financial institutions which are often based on lending is itself an affront to some traditionalists. The imposition of property rights in places where there had been none before - such as in tribal areas where property is held communally - or where they existed in a pre-modern sense - such as in East Africa where they often exist without explicit titles and modern tools of surveying and enclosure - poses considerable difficulties for governments that are faced with the ancient concern of "who gets what." That question can arouse equally ancient concerns of justice, equity, class, and ethnic strife between groups that feel victimized by history. The issue of property rights in developing countries and their implications for free trade has been famously raised by the contemporary Peruvian economist Hernando de Soto.

Free trade can be profoundly redistributive, forcing thousands if not millions to change professions as trade competes their former ones out. In the United States and in many developed countries there are systems of trade adjustment assistance that help to smooth the transition for workers and industries from a pre-globalized economy to an economy transformed by free trade. In countries without those resources, a sense of victimization can rise in laborers displaced by trade that can contribute to a loss of confidence in national policy. It should be observed that even with trade adjustment assistance in the United States, some of the most outspoken resistance to free trade, in particular to the North American Free Trade Agreement, came from labor unions. Even with assistance to smooth a transition between economic structures, there can be resistance to change in the character of an industry for non-economic, social reasons.

Free trade can also change traditional relationships between classes, interest groups, religions, ethnicities, and economic interests that form a once stable, even if not prosperous, society. Balances of power and wealth between groups in society - a disproportionate share of power for a particular industry or group, a disproportionate share of wealth for another - can be shattered by free trade, which tends to be a top-down process that transforms relationships that once formed an implicit "agreement" between disparate groups about the share of power, law, and wealth in society.

Altogether, changes to the national economy can undermine the fragile social fabric of many developing countries. Critics of free trade often point to the fall of the Suharto government in Indonesia in the wake of the Asian economic crisis to describe free trade and its effect on sociopolitical stability. Defenders of free trade point to instability even in countries in autarky and the ability of trade, progress, and prosperity to heal old wounds even in developing countries.

Alternatives, and suggested improvements to, laissez faire trade

The perceived problems above have brought forth much advice from economists and politicians on possible 'solutions'. The typical political option is protectionism, but economist's suggestions have been more wide ranging, for instance...

The Tobin Tax

James Tobin suggest levying a 1% tax on all currency exchange in the FX markets. This was intended to stabilize exchange rates themselves, but a world-wide tax on currency exchange for purchasing imports or repatriating export profits would limit Free trade globally, in the same way that Tariffs reduce the import volume to individual countries (by raising transaction costs).

Fair Trade

The Fair Trade movement advocates political action to restructure, how "free trade" operates, and possibly the volume of international trade. More details in that article.

World government

Some have argued that many of the alleged problems in the current free trade system would be eliminated by having a single world government with one law and no borders. (A single authority with power everywhere would prevent the "race to the bottom" since there would be no-one to race against, and would not restrict the movement of labor, because all citizens would be in the labour pool.)

World government is off-putting to some people on both sides of the argument and is thus rarely posited as a true solution.

International Barter

Some governments have been unwilling to allow trade under the money-price "terms of trade" offered by international capitalism (for instance, because they weren't capitalist). These economies don't always become autarkic, sometimes "organized" trade is arranged between governments outside of the "free" trade system. Most famously, Hjalmar Schacht negotiated bulk barter trades allowing 1930s Germany to bypass the "Free Market", which he thought was 'rigged' by Anglo-American capitalists1.

The Soviet Union arranged bilateral barter trades within its sphere of influence which used geographical comparative advantage outside of a price system. For example, Cuba will always have a comparative advantage in Sugar production over the Urals, in relation to the Ural's ability to produce Wheat. In theory, the "Comprehensive Program for Socialist Economic Integration" was to move the Comecon countries away from "fixed-quota" arrangements to "quota-free" exchanges, which would have been even more liberal (off-market) than inter-country (and inter-enterprise) barter.

Countries in the Arab League have been known to circumvent "Free Trade" with barter arrangement, and countries under embargo have been forced to.

Increase the credit risk to international loans

George Soros and others argue that some on the most destructive free trade (such as developing world agricultural monoculture) is driven by export-orientated production targets set by the IMF and the governments it supports. He suggests that the volume of this trade would be lower if the lending backs were liable for credit default (instead of receiving IMF bail-outs). If banks were responsible for default, the levels of lending would be lower and lead to more sustainable export programs due to the discipline of the free market, he believes.

World-wide price floors

One of the charges against "free trade" is that it is responsible for the decline in international commodity prices which has brought hardship to developing countries dependent on export earnings in such commodities. Part of the reason for such low prices is the over-production of commodities encouraged by non-"free trade" agricultural subsidies in the developed world.

Rather than removing the production subsidy for farmers in the rich world some suggest extending them to farmers in the poor world. (For instance, producers in Poland lobbied to be included in the EC's agricultural subsidy system).

The reason that rich-country farmers need subsidies to thrive is: the comparative advantage of cheap land and labour enjoyed by their poor-country competitors. If the world commodity price floor is set high enough to sustain first-world farming it will be high enough to stimulate massive over-production in developing nations.

Separating world prices from domestic prices

Foreign trade of Communist Czechoslovakia was conducted at "free trade" import prices, with the Ministry of Foreign Trade selling the goods on, into the internal market, at pre-determined prices for each good. In this way, Czechoslovakian consumers were insulated from shifts in world prices whilst having some access to foreign products.

It is difficult for governments to sustain different internal prices over the long term. If the internal price is set below world prices, smugglers try to profit from the differential by illegally exporting the product to nations where they can sell it at a higher price. To the extent smugglers succeed, the domestic government is indirectly subsidizing foreign consumers. This problem has been vividly illustrated in nations where fuel prices are subsidized below world prices; domestic shortages frequently occur as a significant portion of the good is illegally smuggled out of the country. Rationing and black markets are stimulated by artificially low prices; in Iraq the famously long petrol pump queues for petrol at 50 dinars/litre (http://www.cidi.org/humanitarian/hsr/iraq/ixl130.html) can be bypassed by buying on the black market at 250 dinars/litre. Unofficial markets are a common problem wherever the 'official' price is below (or above) the free trade priceTemplate:Ref.

Despite the difficulties of maintaining fixed commodity prices many Governments that attempt it claim that doing so "immunizes" their economies against destabilizing price shocks. It is sometimes argued that the social and economic benefits alone, outweigh the disadvantages (of import-price stability).

Regional trading blocks

James Goldsmith advocated free trade within regional trading blocs, but not between blocs (such as EC countries). If countries within the "customs union" had similar living standards and norms of social and environmental policy they would not race to the bottom. He also proposed protectionism in the goods market, whilst allowing free trade in technology and capital.

Intellectual property and free trade

Historically, the free trade movement was skeptical and even hostile to the notion of intellectual property, regarded it as monopolistic and harmful to a free, competitive economy. Indeed, during the late 19th century, free trade advocates succeeded in reducing the length of the patents available in many European countries. The Netherlands even abolished its patent system (temporarily, as it turned out).

The 19th century anti-patent cause failed largely because the recession of 1874 weakened the free trade movement of the time Template:Ref (and also because patent advocates used a public relations campaign which was remarkably sophisticated for its time).

It is thus remarkable (some would even say ironic) that corporations lobbying for expanded intellectual property privileges have succeeded in including TRIPS, a very strong treaty on intellectual property rights, as a membership requirement for the World Trade Organization, the international organization dedicated to furthering the cause of free trade.

See also

- free market

- free trade zone

- international trade

- privatization

- trade barrier

- trade war

- trade war over genetically modified food

- history of free trade

- offshore outsourcing

- offshoring

- list of international trade topics

- Balanced trade

- NAFTA

- GATT

Notes

- Template:Note In Free Trade Under Attack: What America Can Do (http://www.libertyhaven.com/regulationandpropertyrights/tradeandinternationaleconomics/tradeunderattack.shtml) Professor Murray Weidenbaum argued that Tight-knit special interests are manipulating the political system for greater protectionism, while the more diffused citizen interest suffers. This article (from 1984) echoes the claim of earlier trade theorists (back to Adam Smith) that protectionism is largely a result of a political failure, but comes from a former Chairman of the Council of Economic Advisers to president Reagan, who witnessed the process in 1980s government, and wrote: [P]leas for protectionism reflect the ability of relatively small but influential groups to convince legislatures to adopt policies that benefit them, albeit at the expense of citizens at large. The balance of power is extremely uneven, given the limited knowledge that consumers currently have about these matters. This call for free trade argues that the consumer interest is divided, but assumes that the public would be homogenously in favour of free trade if better educated; this is controversial and not all consumers currently support Free Trade.

- Template:Note Emphasis added to Cobden's quotation of the petition, in a Free Trade speech delivered in 1846, the full text of which is available from cooperativeindividualism.org (http://www.cooperativeindividualism.org/cobdenonfreetrade.html))

- Template:Note Quotation from page 103 of James Goldsmith's THE TRAP, 1994, Macmillan ISBN 0333642244 (summarized in Art Hilgart' review (http://archives.econ.utah.edu/archives/pen-l/1995m05/msg00266.htm)). Goldsmith had a background in corporate takeovers, but breaking up conglomerates within nations would still be permissible in his model, so long as no part of the conglomerate exported outside its area of production. His concern for the harm done to rural societies by the effects of free trade is summarized on page 103 with the sentence: "The cost of such social breakdown can never be measured. The damage is too fundamental."

- Template:Note See The Economist's review of fuel subsidy's effects The Economist online (http://www.economist.com/World/africa/displayStory.cfm?story_id=3502385).

- Template:Note Fritz Machlup & Edith Penrose, "The Patent Controversy in the 19th Century", Journal of Economic History, 10 (1) pp 1-29, 1950.

External links

In favor of free trade

- Global Growth Org (London) (http://www.global-growth.org/)

- Arguments for Free Trade from the Mises Institute (http://www.mises.org/fullstory.asp?control=1084)

- Lewrockwell.com (http://www.lewrockwell.com)

- The Cato Institute's Free Trade website (http://www.freetrade.org/)

- Techcentralstation.com (http://www.techcentralstation.com)

- The Heritage Foundation (http://www.heritage.org)

- The Future of Freedom Foundation (http://www.fff.org)

- The Heartland Institute (http://www.heartland.org)

- The Foundation for Economic Education (http://www.fee.org)

- The American Enterprise Institute (http://www.aei.org)

- The Timbro Institute (Sweden) (http://www.timbro.se)

Opposed to free trade

- Reclaim Democracy - Global Corporatization (http://reclaimdemocracy.org/global_corporatization/)

- David Orchard Campaign for Canada (http://www.davidorchard.com/)

- Friends of the Earth International - Trade Environment & Sustainability Campaign (http://www.foei.org/trade/index.html)

- The Third World Network (http://www.twnside.org.sg/)

- Institute for Agriculture and Trade Policy (http://www.iatp.org/)

- The Council of Canadians (http://www.canadians.org/)

- Our World is Not For Sale Network (http://www.ourworldisnotforsale.org/)

- New Democratic Party of Canada (http://www.ndp.ca/)

- International Institute for Sustainable Development (http://www.iisd.org/trade)

- Public Citizen - Global Trade Watch (USA) (http://www.citizen.org/trade/)

- World Development Movement (UK) (http://www.wdm.org.uk/)

- Trade Justice Movement (UK) (http://www.tradejusticemovement.org.uk/)

- International Society for Ecology and Culture (UK) (http://www.isec.org.uk/)

- Canadian Centre for Policy Alternatives - Trade Project (http://www.policyalternatives.ca/publications/ht-trade.html)

- Oxfam - Free trade (http://www.oxfam.org.uk/coolplanet/milkingit/information/the_issues/free_trade.htm)

- FoodFirst.org 12 myths about hunger - Myth 8: Free trade is the answer (http://www.foodfirst.org/pubs/backgrdrs/1998/s98v5n3.html)

- United States Reform Party

- Ross Perot

- Pat Buchanan (http://www.buchanan.org)

- AFL-CIO (USA) (http://www.aflcio.org/)

- Ralph Nader

- US Green Party (http://www.gp.org/)

- Gone With The World - Arguments against excess free-trade (http://www.gonewiththeworld.com/)

- David Korten's "When Corporations Rule the World". (http://www.pcdf.org/corprule/corporat.htm)

Articles and papers

- In Defence of Globalization, Free Trade and Free Market (http://globalpolitician.com/articles.asp?ID=324)

- Stop Calling It “Free Trade!” (http://reclaimdemocracy.org/global_corporatization/corporate_capitalism_freetrade.html)

- BBC News - The argument for free trade (http://news.bbc.co.uk/2/hi/business/533208.stm)

- Guardian Unlimited - Food & Trade - Hunger in a world of plenty (http://www.guardian.co.uk/worldsummit2002/earth/story/0,,777671,00.html)

Footnotes

1 Officially, the 1933 bilateral-barter policy was designed to ensure that foreign countries bought as much from industrial Germany as she bought from them. However, Milton Friedman has argued ([2] (http://www.freetochoose.net/lecture1n.html)) that Hjalmar Schacht's exchange controls were primarily designed to restrict capital flight.

3 Only in rare cases are transfer payments to the producer actually contemplated. When they have been used, transfer payments have taken the form of short-term government aid. The World Trade Organisation allows some temporary relief measures, but permanent payments to relatively high-cost producers in order to make tariff-repeal Pareto optimal are not politically attractive. The result of ruling out "compensating" payments is that the economic interests of producers and consumers are opposed "within" a country considering her trade policy.de:Freihandel es:Libre comercio fr:Libre échange id:Perdagangan bebas it:Liberismo th:การค้าเสรี