Eurozone

|

|

The Eurozone (also called Euro-area or Euroland) is the subset of European Union member states which have adopted the Euro (€) currency, creating a currency union.

| Contents |

|

1.1 Official members |

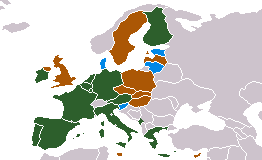

Countries with the Euro as currency

Official members

There are 12 members in the eurozone: Austria, Belgium, Finland, France (except pacific territories using CFP franc), Germany, Greece, Ireland, Italy, Luxembourg, Netherlands, Portugal, and Spain.

The European Central Bank is responsible for the monetary policy within the eurozone.

Blue: ERM II members

Brown: non-Eurozone EU members

Orange: parts of Serbia and Montenegro (outside the Eurozone) that use the Euro

Light Green: non-EU members with currencies pegged to the Euro.

Nations with formal agreements with the EU

Monaco, San Marino, and Vatican City also use the euro, although they are not officially euro members nor members of the EU. (They previously used currencies that were replaced by the euro.) They now mint their own coins, with their own national symbols on the reverse. These countries use the euro by virtue of agreements (http://europa.eu.int/scadplus/leg/en/lvb/l25040.htm) concluded with EU member states (Italy in the case of San Marino and Vatican City, France in the case of Monaco), on behalf of the European Community.

Nations without formal agreements with the EU

Andorra does not have an official currency and hence no specific euro coins. It previously used the French franc and Spanish peseta as de facto legal tender currency. There has never been a monetary arrangement with either Spain or France. However, in May 2005, an agreement was reached between Andorra and the EU on the usage of the Euro (2004/548/EC) (http://europa.eu.int/eur-lex/pri/en/oj/dat/2004/l_244/l_24420040716en00470049.pdf).

Likewise, Montenegro and Kosovo, which used to have the German mark as their de facto currency, also adopted the euro without having entered into any legal arrangements with the EU explicitly permitting them to do so. They use the euro instead of the Serbian dinar, mainly for political reasons.

As of 1 December 2002, North Korea has replaced the US dollar with the euro as its official currency for international trading. (Its internal currency, the won, is not convertible and thus cannot be used to purchase foreign goods.) The euro also enjoys popularity domestically, especially among resident foreigners.

Other nations

Non-Eurozone EU countries

The other 13 countries of the European Union that do not use the euro are : Denmark, Sweden, the United Kingdom, and the ten member states that joined the Union 1 May 2004, namely Cyprus, the Czech Republic, Estonia, Hungary, Latvia, Lithuania, Malta, Poland, Slovakia, and Slovenia.

Denmark and the United Kingdom got special derogations in the original Maastricht Treaty of the European Union. Both countries are not legally required to join the euro unless their governments decide otherwise, either by parliamentary vote or referendum.

The ten new member states should be adopting the euro as soon as appropriate guidelines are met. For these new member states, the single currency was "part of the package" of European Union membership – unlike the UK and Denmark, there is no "opt out" permitted. Sweden also has no opt-out, but its government has made no moves towards fufilling criteria for joining.

The dates these ten states are expected to enter the third stage of the EMU and adopt the euro vary: 2006 for Estonia, 2007 for Cyprus, Lithuania, and Slovenia, 2008 for Latvia, Malta, and Slovakia, 2009 for the Czech Republic and Poland and finally 2010 for Hungary.

Showing the ability to move towards full economic and monetary union is one requisite of "good membership". The ECB and European Commission produce reports every two years analysing the economic and other conditions of non-Eurozone EU members, reporting on their suitability for joining the euro. The first to include the 10 new members was published in October 2004 [1] (http://www.ecb.int/pub/convergence/html/index.en.html).

Inside ERM II

As of 1 May 2004, the ten National Central Banks (NCBs) of the member countries are party to the second European Exchange Rate Mechanism (ERM II) [2] (http://www.centralbank.gov.cy/nqcontent.cfm?a_id=1970&lang=en).

On 28 June 2004, Estonia, Lithuania and Slovenia joined Denmark in the mechanism.

On 2 May, 2005 Cyprus, Latvia and Malta joined in the mechanism.

- Cyprus

The Cyprus pound entered the ERM II on May 2, 2005.

- Denmark

The Danish krone entered the ERM II in 1999, when the euro was created. Since then, it floats against the euro in ±2.25% range.

In Denmark a referendum on joining the euro was held on September 28, 2000, resulting in a 53.2% vote against joining. It is uncertain if a new referendum will be held in the near future.

Note: should Denmark join the euro, Greenland, which is not part of the EU, but of Denmark, would have to hold a separate referendum to decide whether it wants to switch to the euro. The outcome of this possibility is uncertain, as current trends seem to favour independence from Denmark.

- Estonia

Estonia also pegged its currency to the German Mark, and then the euro. Recently, the kroon entered the ERM II agreement.

- Latvia

Latvia joined the ERM II on May 2, 2005. Latvia has a currency board arrangement whose anchor switched from the SDR to the euro on January 1st, 2005. The current lats fluctuation margin is ±1% against the euro.

- Lithuania

The Lithuanian litas (LTL) was pegged to the US dollar until February 2, 2002. when it switched to a euro peg. The country recently entered the ERM II agreement.

- Malta

Malta joined the ERM II on May 2, 2005.

- Slovenia

Slovenia entered the ERM II agreement, and the tolar floats in a ±15% range against the euro.

Outside ERM II

- Czech Republic

- Hungary

- Poland

- Slovakia

- Sweden

Sweden does not have any derogation by any protocol or treaty. Nevertheless, Sweden decided in 1997 not to join the euro from the beginning, and has not made any effort to fulfill the required criteria for a stable exchange rate.

The consultative national referendum on September 14, 2003, resulted in a rejection of adopting the Euro, with the following figures: Yes 42.0%, No 55.9%. Consequently, the decision has been postponed for at least nine years, as Prime Minister Göran Persson wants the results of the referendum to be respected until at least 2012.

- United Kingdom

The British government under prime minister Tony Blair has committed itself to a triple-approval procedure before joining the euro, involving approval by the Cabinet, Parliament, and the British electorate in a referendum.

Unlike other European countries, where the euro is seen mostly as an essential building block in a more politically integrated Europe, in the United Kingdom the possible benefits of eurozone membership are seen mostly as principally economic, and an assessment of British membership based on five economic tests was published on June 9, 2003 by Chancellor of the Exchequer Gordon Brown.

Though maintaining the Government's positive view on the euro, the report came out against membership for the moment, because of the fact that four out of the five tests were not passed.

Chancellor Brown stated [3] (http://politics.guardian.co.uk/Print/0,3858,4687429,00.html) in June 2003 that the best exchange rate for the UK to join the single currency would be around 73 pence per euro (a value which the pair had never reached). This rate has not been formalised as an official condition of entry.

Opinion polls [4] (http://www.mori.com/europe/mori-euro-ref.shtml) in the UK show a consistent majority of the British public to be against joining the euro. Some perceive loss of political and economic sovereignty, others are unconvinced of the case for change from their familiar currency. A referendum in the near future has been ruled out until at least after next general election.

If Britain were to join the euro, it is unclear what would happen in its overseas territories which use the British Pound Sterling. It is conceivable that the euro would only become the official currency in those regions which technically use the currency identified by the code GBP (i.e., Great Britain and Northern Ireland, South Georgia and the South Sandwich Islands), while the regions using their own currencies with a fixed exchange rate of 1 : 1 to the Pound Sterling might keep their currencies with a fixed rate to the euro. Those regions would be the Falkland Islands (Falkland Islands pound - FKP), the Isle of Man (Isle of Man pound), Jersey (Jersey pound), Guernsey (Guernsey pound - GGP), Gibraltar (Gibraltar pound - GIP), and Saint Helena (Saint Helenian pound - SHP). France faced a similar situation on joining solved by areas which used the French Franc directly (eg. French Guiana) switching to the Euro, and regions which used locally issued Francs, pegged to the French Franc, maintaining local currencies but switching thier pegs to the Euro (eg the CFP franc).

Non-EU currencies pegged to the euro

Main article: Currencies related to the euro

- In 1999 the Bulgarian currency was denominated (1 New Lev = 1000 Old Levs) and the value of the lev was fixed to one German mark, therefore its value has since been fixed in relation to the euro.

Although Bulgaria is not a member state yet (member as of January 1 2007), the Bulgarian National Bank (BNB) and the Bulgarian government have agreed on the introduction of the euro in mid 2009, when the Bulgarian National Bank is expected to become part of the eurozone and will receive the right to issue Bulgarian Euro coins. The early accession to the eurozone is due to the extremely tight monetary policy currently in use, which is the result of Bulgaria's agreement with the Monetary Board. Even at this point of time Bulgaria has fulfilled the great majority of eurozone membership critiria.

- Cape Verde's currency was pegged to the Portuguese escudo, and now the euro.

- Bosnia and Herzegovina's currency, the Convertible Mark, was pegged to the German mark (and now the Euro).

- The CFA and CFP francs, used in former French colonies, were pegged to the French franc, and now the euro.

Inflation

- mid 1999: 1%

- mid 2000: 2%

- mid 2001: 2.8%

- mid 2002: 1.9%

- mid 2003: 1.9%

- May 2004: 2.5%

- May 2005: 1.9%

Fiscal policy

For their mutual assurance and stability of the currency, members of the Eurozone have to respect the Stability and Growth Pact, which sets agreed limits on deficits and national debt, with associated sanctions for deviation. [See that article for details].

See also

| European Union (EU) and candidates for enlargement | Missing image European_flag.png Flag of the European Union |

|---|---|

|

Member countries: Austria | Belgium | Cyprus | Czech Republic | Denmark | Estonia | Finland | France | Germany | Greece | Hungary | Ireland | Italy | Latvia | Lithuania | Luxembourg | Malta | Netherlands | Poland | Portugal | Slovakia | Slovenia | Spain | Sweden | United Kingdom | |

|

Acceding countries joining on January 1, 2007: Bulgaria | Romania | |

de:Eurozone fr:Zone euro ga:Limistéar an eoró gl:Eurozona lb:Euro-Zone hu:Eurózóna ro:Zona euro