Monopoly

|

|

- This article is about economic monopoly. For the board game, see Monopoly (game). For the game show based on this board game, see Monopoly (game show).

In economics, a monopoly (from the Greek monos, one + polein, to sell) is defined as a persistent market situation where there is only one provider of a kind of product or service. Monopolies are characterized by a lack of economic competition for the good or service that they provide and a lack of viable substitute goods.

Monopoly should be distinguished from monopsony, in which there is only one buyer of the product or service; it should also, strictly, be distinguished from the (similar) phenomenon of a cartel. In a monopoly a single firm is the sole provider of a product or service; in a cartel a centralized institution is set up to partially coordinate the actions of several independent providers (which is a form of oligopoly).

| Contents |

|

1.1 Legal monopoly |

Forms of monopoly

Monopolies are often distinguished based on the circumstances under which they arise; the main distinctions are between a monopoly that is the result of law (government-granted monopoly and government monopoly) alone; one that arises from the cost structure of the industry (natural monopoly); and one that arise by other means (eg one firm simply outcompeting all other firms; illegal behaviour; etc). Advocates of economic liberalism assert that a more fundamental way of classifying monopolies is to distinguish those that arise and exist due to violation of the principles of a free market (coercive monopoly) from those that arise and are maintained by consistently outcompeting all other firms.

Legal monopoly

A monopoly based on laws explicitly preventing competition is a legal monopoly or de jure monopoly. When such a monopoly is granted to a private party, it is a government-granted monopoly; when it is operated by government itself, it is a government monopoly or state monopoly. A government monopoly may exist at different levels of government (eg just for one region or locality); a state monopoly is specifically operated by a national government.

An example of a "de jure" monopoly is AT&T, which was granted monopoly power by the US government, only to be broken up in 1982 following a Sherman Antitrust suit.

Natural monopoly

Main article: Natural monopoly

A natural monopoly is a monopoly that arises in industries where economies of scale are so large that a single firm can supply the entire market without exhausting them. In these industries competition will tend to be eliminated as the largest (often the first) firm develops a monopoly through its cost advantage. In these industries monopoly may be more economically efficient than competition, although because of potential dynamic efficiencies this is not necessarily clear-cut.

Natural monopoly arises when there are large capital costs relative to variable costs, which arises typically in network industries such as electricity and water. It should be distinguished from network effects, which operate on the demand side and do not affect costs. Counter-intuitively, the case of a monopolization of a key source of a natural resource is not considered a natural monopoly, because it is based on the running down of natural capital rather than the amortization of an investment in physical or human capital.

Whether an industry is a natural monopoly may change over time through the introduction of new technologies. A natural monopoly industry can also be artificially broken up by government, although (eg electricity liberalization, eg Railtrack) the results are at best mixed. Advocates of free markets, such as libertarians, assert that a natural monopoly is a practical impossibility, and, given that a monopoly is a persistent rather than a transient situation, that there is no historical precedent of one ever existing. They say that the idea of "natural monopoly" is mere theoretical abstraction to justify expanding the scope of government, and that it in the case of nationalization or deprivatization it is the government intervention itself that creates a monopoly where one did not actually exist.

Local monopoly

A local monopoly is a monopoly of a market in a particular area, usually a town or even a smaller locality: the term is used to differentiate a monopoly that is geographically limited within a country, as the default assumption is that a monopoly covers the entire industry in a given country. This may include the ability to charge (to some extent) monopoly pricing, for example in the case of the only gas station on an expressway rest stop, which will serve a certain number of motorists who lack fuel to reach the next station and must pay whatever is charged.

Monopolistic competition

Main article: Monopolistic competition

Industries which are dominated by a single firm may allow the firm to act as a near-monopoly or "de facto monopoly", a practice known in economics as monopolistic competition. Common historical examples arguably include corporations such as Microsoft and Standard Oil (Standard's market share of refining was 64% in competition with over 100 other refiners at the time of the trial that resulted in the government-forced breakup). Practices which these entities may be accused of include dumping products below cost to harm competitors, creating tying arrangements between their products, and other practices regulated under Antitrust law.

Large corporations often attempt to monopolize markets through horizontal integration, in which a parent company consolidates control over several small, seemingly diverse companies (sometimes even using different branding to create the illusion of marketplace competition). Such a monopoly is known as a horizontal monopoly. A magazine publishing firm, for example, might publish many different magazines on many different subjects, but it would still be considered to engage in monopolistic practices if the intent of doing this was to control the entire magazine-reader market, and prevent the emergence of competitors.

A monopoly arrived at through vertical integration is called a vertical monopoly. A common example is vertical integration of electricity distribution with electricity generation, which is common because it reduces or eliminates certain costly risks.

Coercive monopoly

Main article: coercive monopoly

A coercive monopoly is one that arises and whose existence is maintained as the result of any sort of activity that violates the principle of a free market and is therefore insulated from competitive forces that would otherwise be a potential threat to its superior status. The term is typically used by those who favor laissez-faire capitalism.

Economic analysis

Primary characteristics of a monopoly

- Single Seller

- A pure monopoly is an industry in which a single firm is the sole producer of a good or the sole provider of a service. This is usually caused by a blocked entry

- No Close Substitutes

- The product or service is unique in ways which go beyond brand identity, and cannot be easily replaced (a monopoly on water from a certain spring, sold under a certain brand name, is not a true monopoly; neither is Coca-Cola, even though it is differentiated from its competition in flavor)

- Price Maker

- In a pure monopoly a single firm controls the total supply of the whole industry and is able to exhert a significant degree of control over the price, by changing the quantity supplied. In subtotal monopolies (for example diamonds or petroleum at present) a single organization controls enough of the supply that even if it limits the quantity, or raises prices, the other suppliers will be unable to make up the difference and take significant amounts of market share.

- Blocked Entry

- The reason a pure monopolist has no competitors is that certain barriers keep would be competitors from entering the market. Depending upon the form of the monopoly these barriers can be economic, technological, legal (basic patents on certain drugs), or of some other type of barrier that completely prevents other firms from entering the market

Monopolistic pricing

In economics a company is said to have monopoly power if it faces a downward sloping demand curve (see supply and demand). This is in contrast to a price taker that faces a horizontal demand curve. A price taker cannot choose the price that they sell at, since if they set it above the equilibrium price, they will sell none, and if they set it below the equilibrium price, they will have an infinite number of buyers (and be making less money than they could if they sold at the equilibrium price). In contrast, a business with monopoly power can choose the price they want to sell at. If they set it higher, they sell less. If they set it lower, they sell more.

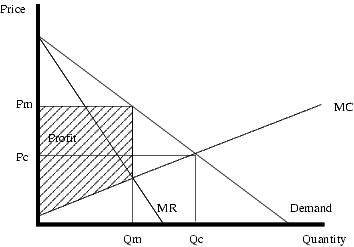

If a monopoly can only set one price it will set it where marginal cost (MC) equals marginal revenue (MR) as seen on the diagram on the right. This can be seen on a supply and demand diagram for the firm. This will be at the quantity Qm and at the price Pm. This is above the competitive price of Pc and with a smaller quantity that the competitive quantity of Qc. The profit the monopoly gains is the shaded in area labeled profit.

As long as the price elasticity of demand (in absolute value) for most customers is less than one, it is very advantageous to increase the price: the seller gets more money for less goods. With an increase of the price the price elasticity tends to rise, and in the optimum mentioned above it will for most customers be above one. A formula gives the relation between price, marginal cost of production and demand elasticity which maximizes a monopoly profit: <math>\frac{P}{MC} = \frac{1}{1 + 1 / e}<math> (known as Lerner Index).

The economy as a whole loses out when monopoly power is used in this way, since the extra profit earned by the firm will be smaller than the loss in consumer surplus. This difference is known as a deadweight loss.

Calculating monopoly output

The single price monopoly profit maximisation problem is as follows:

The monopoly's profit is its total revenue less its total cost. Let the price it sets as a market response be a function of the quantity it produces (Q) <math>P(Q)<math> and let its cost function be as a function of quantity <math>C(Q)<math>. The monopoly's revenue is the product of the price and the quantity it produces. Hence its profit is:

<math> \Pi\ = P(Q).Q - C(Q)<math>

Taking the first order derivative with respect to quantity yields:

<math>\frac{d \Pi\ }{dQ} = P'(Q).Q + P(Q) - C'(Q)<math>

Setting this equal to zero for maximisation:

<math> \frac{d \Pi\ }{dQ} = P'(Q).Q + P(Q) - C'(Q)=0<math>

<math> \frac{d \Pi\ }{dQ} = P'(Q).Q + P(Q)= C'(Q)<math>

i.e. marginal revenue = marginal cost, provided

<math> \frac{d^2 \Pi\ }{dQ^2} = P''(Q).Q + (Q+1).P'(Q) +P(Q) - C''(Q) < 0<math> (the rate of marginal revenue is less than the rate of marginal cost, for maximisation).

Monopoly and efficiency

In standard economic theory (see analysis above), a monopoly will sell a lower quantity of goods at a higher price than firms would in a purely competitive market. In this way the monopoly will secure monopoly profits by appropriating some or all of the consumer surplus, as although the higher price deters some consumers from purchasing, most are willing to pay the higher price. Assuming that costs stay the same, this does not lead to an outcome which is inefficient in the sense of Pareto efficiency; no-one could be made better off by shifting resources without making someone else worse off. However, total social welfare declines compared with perfect competition, because some consumers must choose second-best products.

It is also often argued that monopolies tend to become less efficient and innovative over time, becoming "complacent giants", because they don't have to be efficient or innovative to compete in the marketplace. Sometimes this very loss of efficiency can raise the potential value of a competitor enough to overcome market entry barriers, or provide incentive for research and investment into new alternatives. The theory of contestable markets argues that in some circumstances (private) monopolies are forced to behave as if there were competition, because of the risk of losing that monopoly to new entrants, or because of the availability in the longer-term of substitutes in other markets. For example, a canal monopoly in the late eighteenth century United Kingdom was worth a lot more than in the late nineteenth century, because of the introduction of railways as a substitute.

Some argue that it can be good to allow a firm to attempt to monopolize a market, since practices such as dumping can benefit consumers in the short term; and once the firm grows too big, it can then be dealt with via regulation. (This is a rather optimistic view of how effectively regulation can substitute for competition.) When monopolies are not broken through the open market, often a government will step in to either regulate the monopoly, turn it into a publicly-owned monopoly, or forcibly break it up (see Antitrust law). Public utilities, often being natural monopolies and less susceptible to efficient breakup, are often strongly regulated or publicly-owned. AT&T and Standard Oil are debatable examples of the breakup of a private monopoly. When AT&T was broken up into the "Baby Bell" components, MCI, Sprint, and other companies were able to compete effectively in the long-distance phone market and started to take phone traffic from the less efficient AT&T.

Historical examples

Salt

Until common salt (sodium chloride) was mined in quantity in comparatively recent times, its availability was subject to the vagaries of climate and environment. A combination of strong sunshine and low humidity or an extension of peat marshes were necessary for winning salt from the sea - the most plentiful source - by solar evaporation or boiling. Mines and inland salt springs being scarce and often located in hostile areas like the Dead Sea or the salt mines in the Sahara desert, they required well-organised security for transport, storage and highly monopolised distribution. Changing sea levels flooded many of these sources during certain periods and caused salt 'famines' and communities were left to the mercy of those who monopolised these few inland sources. The "Gabelle", a notoriously high tax levied upon salt, resulted in the French revolution and is possibly the most cruel example in recent history. Anyone was allowed to purchase salt, however, this was not the case as far as who was allowed to sell and distribute salt as this was subject to strict legal controls. Advocates of laissez-faire capitalism, such as the Austrian school, maintain that a salt monopoly would never develop without such government intervention. Just as with other products and services commonly provided by voluntary interactions within the economic market such as food, water and shelter, mankind can not live without salt, and thus monopolising salt is semantically identical to the free-market distribution of these commodities.

- Salt and the evolution of monopoly (http://salt.org.il/frame_econ.html)

See also

- Market form | Duopoly | Oligopoly | Perfect competition

- Free market

- United States v. Microsoft

- Monopsony

- Oligopoly

- Long tail

- Price discriminationbg:Монопол

da:Monopol de:Monopol es:Monopolio fr:Monopole id:Monopoli it:Monopolio he:מונופול nl:Monopolie (economie) ja:独占 no:Monopol pl:Monopol pt:Monopólio fi:Monopoli tr:Tekel zh:垄断