Model (economics)

|

|

In economics, a model is a theoretical construct that represents economic processes by a set of variables and a set of logical and quantitative relationships between them. As in other fields, models are simplified frameworks designed to illuminate complex processes.

| Contents |

Overview

In general terms, economic models are a simplification of and abstraction from observed data. Simplification is particularly important for economics given the enormous complexity of economic processes. This complexity can be attributed to the diversity of factors that determine economic activity; these factors include: individual and cooperative decision processes, resource limitations, environmental and geographical constraints, institutional and legal requirements and purely random fluctuations. Economists therefore must make a reasoned choice of which variables and which relationships between these variables are relevant and which ways of analyzing and presenting this information are useful.

In addition to their professional academic interest, the use of models include:

- Forecasting economic activity in a way in which conclusions are logically related to assumptions;

- Proposing economic policy to modify future economic activity;

- Presenting reasoned arguments to politically justify economic policy at the national level, to explain and influence company strategy at the level of the firm, or to provide intelligent advice for household economic decisions at the level of households.

- Planning and allocation, in the case of centrally planned economies, and on a smaller scale in logistics and management of businesses.

- In finance predictive models have been used since the 1980s for trading (investment, and speculation), for example emerging market bonds were often traded based on economic models predicting the growth of the developing nation issuing them. Since the 1990s many long-term risk management models have incorporated economic relationships between simulated variables in an attempt to detect high-exposure future scenarios (often through a Monte Carlo method).

Obviously any kind of reasoning about anything uses representations by variables and logical relationships. A model however establishes an argumentative framework for applying logic and mathematics that can be independently discussed and tested and that can be applied in various instances. Policies and arguments that rely on economic models have a clear basis for soundness, namely the validity of the supporting model.

Economic models in current use have no pretensions of being theories of everything economic; any such pretensions would immediately be thwarted by computational infeasibility and the paucity of theories for most types of economic behavior. Therefore conclusions drawn from models will be approximate representations of economic facts. However, properly constructed models can remove extraneous information and isolate useful approximations of key relationships. In this way more can be understood about the relationships in question than by trying to understand the entire economic process.

The details of model construction vary with type of model and its application, but a generic process can be identified. Generally any modelling process has two steps: generating a model, then checking the model for accuracy (sometimes called diagnostics). The diagnostic step is important because a model is only useful to the extent that it accurately mirrors the relationships that it purports to describe. Creating and diagnosing a model is frequently an iterative process in which the model is modified (and hopefully improved) with each iteration of diagnosis and respecification. Once a satisfactory model is found, it should be double checked by applying it to a different data set.

Types of models

Broadly speaking economic models are stochastic or non-stochastic; discrete or continuous choice.

- Stochastic models are formulated using stochastic processes. They model economically observable values over time. Most of econometrics is based on statistics to formulate and test hypotheses about these processes or estimate parameters for them. A widely used class of econometric models popularized by Tinbergen and later Wold are autoregressive models, in which the stochastic process satisfies some relation between current and past values. Examples of these are autoregressive moving average models and related ones such as autoregressive conditional heteroskedasticity (ARCH) and GARCH models for the modelling of heteroskedasticity.

- Non-stochastic mathematical models may be purely qualitative (for example, models involved in some aspect of social choice theory) or quantitative (involving rationalization of financial variables, for example with hyperbolic coordinates, and/or specific forms of functional relationships between variables). In some cases economic predictions of a model merely assert the direction of movement of economic variables, and so the functional relationships are used only in a qualitative sense: for example, if the price of an item increases, then the demand for that item will decrease. For such models, economists often use two-dimensional graphs instead of functions.

- Qualitative models - Although almost all economic models involve some form of mathematical or quantitative analysis, qualitative models are occasionally used. One example is qualitative scenario planning in which possible future events are played out. Another example is non-numerical decision tree analysis. Qualitative models often suffer from lack of precision.

At a more practical level, quantitative modelling is applied to many areas of economics and several methodologies have evolved more or less independently of each other. As a result, no overall model taxonomy is naturally available. We can nonetheless provide a few examples which illustrate some particularly relevant points of model construction.

- An accounting model is one based on the premise that for every credit there is a debit. More symbolically, an accounting model expresses some principle of conservation in the form

- algebraic sum of inflows = sinks - sources

- This principle is certainly true for money and it is the basis for national income accounting. Accounting models are true by convention, that is any experimental failure to confirm them, would be attributed to fraud, arithmetic error or an extraneous injection (or destruction) of cash which we would interpret as showing the experiment was conducted improperly.

- Optimality and constrained optimization models - Other examples of quantitative models are based on principles such as profit or utility maximization. An example of such a model is given by the comparative statics of taxation on the profit-maximizing firm. The profit of a firm is given by

- <math> \pi(x,t) = x p(x) - C(x) - t x \quad<math>

- where <math>p(x)<math> is the price that a product commands in the market if it is supplied at the rate <math>x<math>, <math>xp(x)<math> is the revenue obtained from selling the product, <math>C(x)<math> is the cost of bringing the product to market at the rate <math>x<math>, and <math>t<math> is the tax that the firm must pay per unit of the product sold.

- The profit maximization assumption states that a firm will produce at the output rate x if that rate maximizes the firm's profit. Using differential calculus we can obtain conditions on x under which this holds. The first order maximization condition for x is

- <math> \frac{\partial \pi(x,t)}{\partial x} =\frac{\partial (x p(x) - C(x))}{\partial x} -t= 0 <math>

- Regarding x is an implicitly defined function of t by this equation (see implicit function theorem), one concludes that the derivative of x with respect to t has the same sign as

- <math> \frac{\partial^2 (x p(x) - C(x))}{\partial^2 x}={\partial^2\pi(x,t)\over \partial x^2},<math>

- which is negative if the second order conditions for a local maximum are satisfied.

- Thus the profit maximization model predicts something about the effect of taxation on output, namely that output decreases with increased taxation. If the predictions of the model fail, we conclude that the profit maximization hypothesis was false; this should lead to alternate theories of the firm, for example based on bounded rationality.

- Borrowing a notion apparently first used in economics by Paul Samuelson, this model of taxation and the predicted dependency of output on the tax rate, illustrates an operationally meaningful theorem; that is one which requires some economically meaningful assumption which is falsifiable under certain conditions.

- Aggregate models. Macroeconomics needs to deal with aggregate quantities such as output, the price level, the interest rate and so on. Now real output is actually a vector of goods and services, such as cars, passenger airplanes, computers, food items, secretarial services, home repair services etc. Similarly price is the vector of individual prices of goods and services. Models in which the vector nature of the quantities is maintained are used in practice, for example Leontief input-output models are of this kind. However, for the most part, these models are computationally much harder to deal with and harder to use as tools for qualitative analysis. For this reason, macroeconomic models usually lump together different variables into a single quantity such as output or price. Moreover, quantitative relationships between these aggregate variables are often parts of important macroeconomic theories. This process of aggregation and functional dependency between various aggregates usually is interpreted statistically and validated by econometrics. For instance, one ingredient of the Keynesian model is a functional relationship between consumption and national income: C = C(Y). This relationship plays an important role in Keynesian analysis.

Pitfalls

Restrictive, unrealistic assumptions

Economic models can be such powerful tools in understanding some economic relationships, that it is easy to ignore their limitations. For example, perfect-competition equilibrium market models. These models are based on perfect information, an identical product, and inability of individual agents to significantly affect total output or demand. When these assumptions are met, the resulting static equilibrium conditions will be Pareto optimal. One can interpret optimality as an ideal situation in which each agent can do no better. When these assumptions fail, for instance under imperfect information or product differentiation, the model cannot be used to draw these conclusions (nor can the propositions be shown false; alternative methods, such as experimental economics are required).

An economic model that has been established to have validity in explaining a relationship under one set of assumptions, is useless if the assumptions are not valid. Model assumptions include not only those can be expressed as predicates on model parameters but others with more qualitative or asymptotic form. This basic concept is however surprisingly often ignored. A common example is the application of Keynesian economics to government fiscal policy. The simple Keynesian model postulates (among other things) that output is a function of aggregate demand. Government spending is one component of aggregate demand, so Keynes' model is often applied to conclude that increasing government spending will have the same positive effect on output as private investment (see the article by Paul Samuelson, Simple Mathematics of Income Determination). This application of the model is correct in the short run, but the model does not take into account the results of this policy change, which may affect business cycles, interest and tax rates, private investment, and other factors which could in the long run either reduce or increase output as a result of the change in fiscal policy. This example highlights one of the difficulties of applying economic models, which is correctly inferring short term and long term effects of economic policy.

Omitted details

A great danger inherent in the simplification required to fit the entire economy into a model is omitting critical elements. Some economists believe that making the model as simple as possible is an art form, but the details left out are often contentious. For instance:

- Market models often exclude externalities such as unpunished pollution. Such models are the basis for many environmental attacks on mainstream economists, for including the price of everything but the value of nothing in their models. It is said that if the social costs of externalities were included in the models their conclusions would be very different, and models are often accused of leaving out these terms because of economist's pro-free market bias.

- In turn, environmental economics has been accused of omitting key financial considerations from its models. For example the returns to solar power investments are sometimes modelled without a discount factor, so that the present utility of solar energy delivered in a century's time is precisely equal to gas-power station energy today.

- Financial models can be oversimplified by relying on historically unprecedented arbitrage-free markets, probably underestimating the chance of crises, and under-pricing or under-planning for risk.

- Models of consumption either assume that humans are immortal or that teenagers plan their life around an optimal retirement supported by the next generation. (These conclusions are probably harmless, except possibly to the credibility of the modelling profession.)

Are economic models falsifiable?

The sharp distinction between falsifiable economic models and those that are not is by no means a universally accepted one. Indeed one can argue that the ceteris paribus (all else being equal) qualification that accompanies any claim in economics is nothing more than an all-purpose escape clause. See the N. de Marchi and M. Blaug collection for a philosophical discussion of these issues. The all else being equal claim allows holding all variables constant except the few that the model is attempting to reason about. This allows the separation and clarification of the specific relationship. However, in reality all else is never equal, so economic models are guaranteed to not be perfect. The goal of the model is that the isolated and simplified relationship has some predictive power that can be tested. Ignoring the fact that the ceteris paribus assumption is being made is another big failure often made when a model is applied. At the minimum an attempt must be made to look at the various factors that may not be equal and take those into account.

History

One of the major problems addressed by economic models has been understanding economic growth. An early attempt to provide a technique to approach this came from the French physiocratic school in the Eighteenth century. Among these economists, François Quesnay should be noted, particularly for his development and use of tables he called Tableaux économiques. These tables have in fact been interpreted in more modern terminology as a Leontiev model, see the Phillips reference below.

All through the 18th century (that is, well before the founding of modern political economy, conventionally marked by Adam Smith's 1776 Wealth of Nations) simple probabilistic models were used to understand the economics of insurance. This was a natural extrapolation of the theory of gambling, and played an important role both in the development of probability theory itself and in the development of actuarial science. Many of the giants of 18th century mathematics contributed to this field. Around 1730, De Moivre addressed some of these problems in the 3rd edition of the Doctrine of Chances. Even earlier (1709), Nicolas Bernoulli studies problems related to savings and interest in the Ars Conjectandi. In 1730, Daniel Bernoulli studied "moral probability" in his book Mensura Sortis, where he introduced what would today be called "logarithmic utility of money" and applied it to gambling and insurance problems, including a solution of the paradoxical Saint Petersburg problem. All of these developments were summarized by Laplace in his Analytical Theory of Probability (1812). Clearly, by the time David Ricardo came along he had a lot of well-established math to draw from.

Tests of macroeconomic predictions

In the late 1980s a research institute compared the twelve top macroeconomic models available at the time. They asked the designers of these models what would happen to the economy under a variety of quantitatively specified shocks, and compared the diversity in the answers (allowing the models to control for all the variability in the real world; this was a test of model vs. model, not a test against the actual outcome). Although the designers were allowed to simplify the world and start from a stable, known baseline (e.g NAIRU unemployment) the various models gave dramatically different answers. For instance, in calculating the impact of a monetary loosening on output some models estimated a 3% change in GDP after one year, and one gave almost no change, with the rest spread between.

Partly as a result of such experiments, modern central bankers no longer have as much confidence that it is possible to ‘fine-tune’ the economy as they had in the 1960s and early 1970s. Modern policy makers tend to use a less activist approach, explicitly because the have a lack of confidence that their models will actually predict where the economy is going, or the effect of any shock upon it. The new, more humble, approach sees danger in dramatic policy changes based on model predictions, because of several practical and theoretical limitations in current macroeconomic models; in addition to the theoretical pitfalls, (listed above) some problems specific to aggregate modelling are:

- Limitations in model construction caused by difficulties in understanding the underlying mechanisms of the real economy. (Hence the profusion of separate models.)

- The law of Unintended consequences, on elements of the real economy not yet included in the model.

- The time lag in both receiving data and the reaction of economic variables to policy makers attempts to ‘steer’ them (mostly through monetary policy) in the direction that central bankers want them to move. Milton Friedman has vigorously argued that these lags are so long and unpredictably variable that effective management of the macroeconomy is impossible.

- The difficulty in correctly specifying all of the parameters (through econometric measurements) even if the structural model and data were perfect.

- The fact that all the model's relationships and coefficients are stochastic, so that the error term becomes very large quickly, and the available snapshot of the input parameters is already out of date.

- Modern economic models incorporate the reaction of the public & market to the policy maker's actions (through game theory), and this feedback is included in modern models (following the rational expectations revolution and Robert Lucas's critique of the optimal control concept of precise macroeconomic management). If the response to the decision maker's actions (and their credibility) must be included in the model then it becomes much harder to influence some of the variables simulated.

Comparison with models in other sciences

The comparison of economic forecasting to weather forecasting using (much more sophisticated) simulations shows the present state of economic modelling in an unflattering light. Although meteorological simulations are capable of only about five days reliability, this is all they claim to predict; the medium and long term macroeconomic models presently available often have similar predictive power to 1930s weather forecasters looking five days ahead.

The effects of deterministic chaos on economic models

Economic and meteorological simulations may share a fundamental limit to their predictive powers: chaos. Although the modern mathematical work on chaotic systems began in the 1970s the danger of chaos had been identified and defined in Econometrica as early as 1958:

- "Good theorising consists to a large extent in avoiding assumptions....(with the property that)....a small change in what is posited will seriously affect the conclusions."

- (William Baumol, Econometrica, 26 see: Economics on the Edge of Chaos (http://www.iemss.org/iemss2004/pdf/keynotes/Keynote_OXLEY.pdf)).

It is straightforward to design an economic models susceptible to butterfly effects of initial-condition sensitivity. See, for instance: Review of chaotic models from 2003 (http://www.sp.uconn.edu/~ages/files/NL_Chaos_and_%20Macro%20-%20429%20Essay.pdf)

However, the econometric research program to identify which variables are chaotic (if any) has largely concluded that aggregate macroeconomic variables probably do not behave chaotically. This would mean that refinements to the models could ultimately produce reliable long-term forecasts. However the validity of this conclusion has generated two challenges:

- In 2004 Philip Mirowski challenged this view and those who hold it, saying that chaos in economics is suffering from a biased "crusade" against it by neo-classical economics in order to preserve their mathematical models.

- The variables in finance may well be subject to chaos. Also in 2004, the University of Cantebury study Economics on the Edge of Chaos concludes that after noise is removed from S&P 500 returns, evidence of deterministic chaos is found.

The critique of hubris in modelling

A key strand of free market economic thinking is that the market's "invisible hand" guides an economy to prosperity more efficiently than central planning using an economic model. One reason is the claim that many of the true forces shaping the economy can never be captured in a single plan. This is an argument which can not be made through a conventional (mathematical) economic model, because it says that there are critical systemic-elements that will always be omitted from any top-down analysis of the economy. (Including such an affect within a model would lead to a paradox, if the theory that the affect cannot be anticipated by a planner were true.)

Examples of economic models

- Keynesian cross

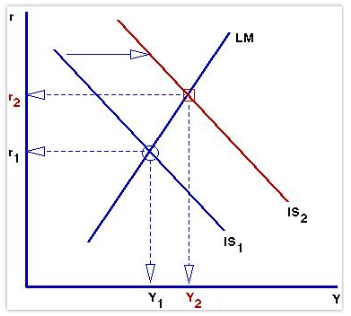

- IS/LM model

- Black-Scholes option pricing model

- Leontief's input-output model

- Heckscher-Ohlin model

See also

References

- W. Baumol and A. Binder, Economics: Principles and Policy 2ed., Harcourt Brace Jovanovich, Inc. 1982.

- Bruce Caldwell, Beyond Positivism Revised edition, Routledge, 1991.

- R. Holcombe, Economic Models and Methodology, Greenwood Press, 1989. Defines model by analogy with maps, an idea borrowed from Baumol and Blinder. Discusses deduction within models, and logical derivation of one model from another. Chapter 9 compares the neoclassical school and the Austrian school, in particular in relation to falsifiability.

- Oskar Lange The Scope and Method of Economics, Review of Economic Studies, 1945. One of the earliest studies on methodology of economics, analysing the postulate of rationality.

- N. B. de Marchi and M. Blaug., Appraising Economic Theories, Edward Elgar, 1991. A series of essays and papers analysing questions about how (and whether) models and theories in economics are empirically verified and the current status of positivism in economics.

- M. Morishima, The Economic Theory of Modern Society, Cambridge University Press, 1976. A thorough discussion of many quantitative models used in modern economic theory. Also a careful discussion of aggregation.

- A. Phillips, The Tableau Économique of a Simple Leontiev Model, Quarterly Journal of Economics, 69, 1955 pp 137-44.

- Paul Samuelson, Foundations of Economic Analysis, Atheneum, 1965. Originally published by Harvard University Press in 1947. This is a classic book carefully discussing comparative statics in microeconomics, though some dynamics is studied as well as some macroeconomic theory. This should not be confused with Samuelsons' popular textbook.

- Paul Samuelson, The Simple Mathematics of Income Determination, in: Income, Employment and Public Policy; essays in honor of Alvin Hansen, W. W. Norton, 1948

- J. Tinbergen, Statistical Testing of Business Cycle Theories, League of Nations, 1939

- H . Wold, A Study in the Analysis of Stationary Time Series, Almqvist and Wicksell, 1938

- H. Wold and L. Jureen, Demand Analysis A Study in Econometrics, 1953

External links

- H. Varian How to build a model in your spare time (http://www.sims.berkeley.edu/~hal/Papers/how.pdf) The author makes several unexpected suggestions: Look for a model in the real world, not in journals. Look at the literature later, not sooner.