Stock market downturn of 2002

|

|

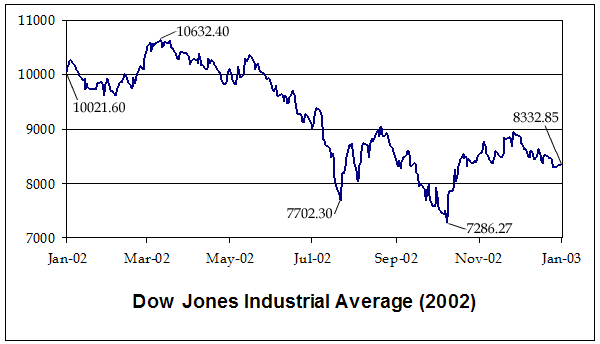

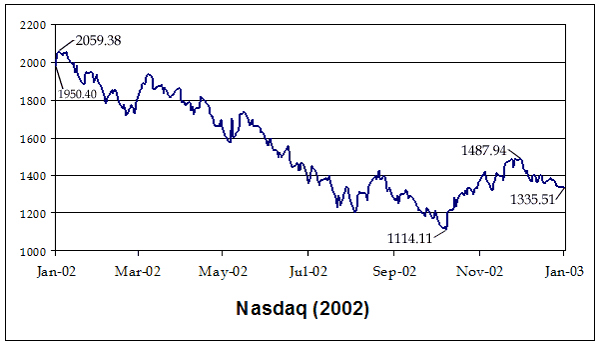

The stock market downturn of 2002 (some say "stock market crash") is the sharp drop in stock prices during 2002 in stock exchanges across the United States and Europe. After recovering from lows reached following the September 11, 2001 attacks, indices slid steadily starting in March 2002, with dramatic declines in July and September leading to lows last reached in 1997 and 1998. The dollar declined steadily against the euro, reaching a 1-to-1 valuation not seen since the euro's introduction.

This downturn can be viewed as part of a larger bear market or correction, after a decade-long bull market had led to unusually high stock valuations. An outbreak of accounting scandals was a contributing factor to the speed of the fall, as numerous large corporations were forced to restate earnings and investor confidence suffered.

The International Monetary Fund has expressed concern about instability in United States stock markets.

The Nasdaq stock market peaked in March 2000, closing with over 5,000 for just two days March 9 and 10. Its peak was at 5,048.62 (intra-day peak 5,132.52) at the close of trading on March 10, 2000. The Dow Jones Industrial Average, an average of 30 large companies on the New York Stock Exchange, peaked in January 2000. Its peak was at 11,722.98 (intra-day peak 11,750.28) on January 14, 2000, yet a year later is was largely unchanged with another peak of 11,337.92 (intra-day peak 11,350.05) on May 21, 2001.

From 1987 to 1995, the Dow Jones Industrial Average rose each year by about 10%. From 1995 to 2000, the Dow rose 15% a year. A bear market began in 2000; by July/August 2002, the Dow dropped to the same level it would have been if the 10% annual growth rate it followed during 1987-1995 had continued up to 2002.

After falling for 11 days and reaching a low below Dow 8000 on July 23, 2002, the market rallied, rising 15% over the next four trading days rising to over Dow 9000 during August. Indices fell sharply again on August 2 and 3. On August 5, stocks continued their decline, Nasdaq breaking the July 23 low. The markets rose sharply over the rest of the week.

| Contents |

Scale

The Dow dropped to a four-year low on September 24, 2002. Stocks on the Nasdaq reached a 6-year low. As of September 24 the Dow Jones Industrial Average had lost 27% of the value it had in January 1, 2001, at a total loss of 5 trillion dollars. The markets continued their declines, breaking the September low to five-year lows on October 6. It should be noted that the Dow Jones had already lost 9% of its value from its peak, and the Nasdaq had lost 44% of its value from its peak.

Stocks recovered slightly from their October lows, with the Dow remaining in the mid-8000s from November 2002 to mid-January 2003.

At the top in March of 2000 all NYSE listed companies was priced at $12.9 trillion and all NASDAQ listed companies was priced at $5.4 trillion (12.9+5.4=18.3). NASDAQ subsequently fell by 80% and the S&P 500 fell by 45% until October 2002. NYSE and NASDAQ companies did then cost $7+2 trillion. That's a $9.3 trillion fall in market cap (18.3-9=9.3) at NYSE and Nasdaq. Now (6/30/2004) the market cap according to [1] (http://www.nyse.com/Frameset.html?displayPage=/marketinfo/1022963613722.html) is $32.3 trillion for the larger exchanges (NYSE $11.6, Nasdaq $2.9, Tokyo Stock Exchange $3.4, London Stock Exchange $2.5, Euronext $2.1, Deutsche Borse $1.1, AMEX $0.1).

Index levels

To put the downturn of 2002 in perspective, here is a look at U.S. stock market declines in 2000, 2001, and 2002:

- Nasdaq

- In 2000, the Nasdaq lost 39.28% of its value (4,069.31 to 2,470.52).

- In 2001, the Nasdaq lost 21.05% of its value (2,470.52 to 1,950.40).

- In 2002, the Nasdaq lost 31.53% of its value (1,950.40 to 1,335.51).

- Dow Jones Industrial Average

- In 2000, the Dow lost 6.17% of its value (11,497.10 to 10,788.00)

- In 2001, the Dow lost 5.35% of its value (10,788.00 to 10,021.60)

- In 2002, the Dow lost 16.76% of its value (10,021.60 to 8,341.63)

Here is a broader view of the stock market downturn of 2001-2002 with numbers from the stock market bubble of the late 1990s:

| Date | Nasdaq | % Chng.§ | Dow Jones | % Chng.§ | Notes |

|---|---|---|---|---|---|

| January 1, 1997 | 1,291.03 | — | 6,448.30 | — | |

| January 1, 1998 | 1,570.35 | +21.63% | 7,908.30 | +22.64% | |

| January 1, 1999 | 2,192.69 | +39.63% | 9,181.40 | +16.10% | |

| January 1, 2000 | 4,069.31 | +85.58% | 11,497.10 | +25.22% | |

| January 14, 2000 | 4,064.27 | -0.12% | 11,723.00 | +1.97% | The day the DJIA peaked. |

| March 10, 2000 | 5,048.62 | +24.22% | 9,928.80 | -15.31% | The day the Nasdaq peaked. |

| January 1, 2001 | 2,470.52 | -51.07% | 10,788.00 | +8.65% | |

| January 20, 2001 | 2,770.38 | +12.14% | 10,587.60 | -1.86% | President Bush takes office. |

| September 10, 2001 | 1,695.38 | -38.80% | 9,605.50 | -9.28% | Levels before September 11, 2001 attacks. |

| September 21, 2001 | 1,423.19 | -16.05% | 8,235.80 | -14.26% | Lows after markets reopened. |

| January 1, 2002 | 1,950.40 | +37.04% | 10,021.60 | +21.68% | |

| October 9, 2002 | 1,114.11 | -42.88% | 7,286.27 | -27.29% | 2002 lows. |

| January 1, 2003 | 1,335.51 | +19.87% | 8,341.63 | +14.48% | |

| January 1, 2004 | 2,003.37 | +50.01% | 10,453.92 | +25.32% |

- §Values represent percent change from previous date listed in table.

See also

References and External Links

- Rally Sends Major Gauges to Gains of More Than 5%, The New York Times, July 30, 2002 (http://www.nytimes.com/2002/07/30/business/30STOX.html)

- NEWS ANALYSIS: What Will Halt the Skid on Wall Street?, The New York Times, July 22, 2002 (http://www.nytimes.com/2002/07/22/business/22STOX.html)

- The Confidence Crisis, The New York Times, July 21, 2002 (http://www.nytimes.com/2002/07/21/opinion/21SUN1.html)

- Stocks Continue Four-Month Rout; Dow Plunges 390, The New York Times, July 20, 2002 (http://www.nytimes.com/2002/07/20/business/20STOX.html)

- MARKET PLACE: Adding to Loss of Investments, a Loss of Faith in the Market, The New York Times, July 20, 2002 (http://www.nytimes.com/2002/07/20/business/20PLAC.html)

- SCREAM! Hold On for a Wild Ride, The New York Times, July 21, 2002 (http://www.nytimes.com/2002/07/21/weekinreview/21BERE.html)

- S.&P. 500 Index Drops to Its Lowest Level Since 1997, Bloomberg News, July 19, 2002 (http://www.nytimes.com/2002/07/19/business/19STOX.html)

- Doubts about US political leadership (http://www.nytimes.com/2002/10/01/opinion/01KRUG.html?todaysheadlines)fr:Bulle Internet