Pigovian tax

|

|

A Pigovian tax is a tax levied to correct the negative social side-effects of an activity. For instance, a Pigovian tax may be levied on producers who pollute the environment to encourage them to reduce pollution, and to provide revenue which may be used to counteract the negative effects of the pollution. Certain types of Pigovian taxes are sometimes referred to as sin taxes, for example taxes on alcohol and cigarettes.

Pigovian taxes are named after economist Arthur Pigou (1877-1959) who also developed the concept of economic externalities.

| Contents [hide] |

Economic efficiency of Pigovian taxes

Unlike most taxes, which are inefficient because they result in a deadweight loss, Pigovian taxes improve overall social utility as they tend to reduce a negative externality while raising tax revenue.

Workings of Pigovian tax

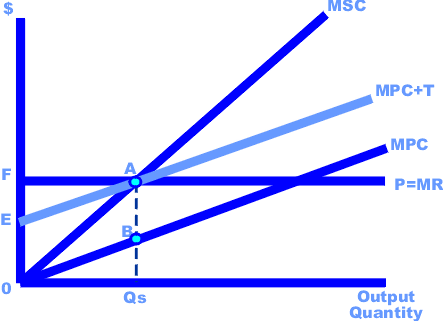

The diagram to the right illustrates the working of a Pigovian tax. A tax shifts the marginal private cost curve (MPC) up by the amount of the tax (to MPC + T). Faced with this cost increase, the producers have an incentive to reduce output to the socially optimum level (Qs), so that the tax will tend to reduce the amount of the externality. The total government revenue from the tax (which is available to be used to mitigate the effect of the negative externality) is equal to the area 0EAB. The profit to the firm is equal to the area EAF.

A key problem with Pigovian tax is that of calculating what level of tax will counterbalance the negative externality. Political factors such as lobbying of government by polluters may also tend to reduce the level of the tax levied, which will tend to reduce the mitigating effect of the tax.

Pollution taxes

One argument that has been put forward against the levying of Pigovian pollution taxes is that in certain conditions they can lead to a level of pollution that is less than the social optimum. With a Pigovian tax there is always an incentive to reduce pollution. The alternative, regulation, is viewed as having a higher cost to society because Pigovian taxes raise revenue, while regulation does not. On the other hand, once a company has achieved the regulated level of pollution it has no incentive to further reduce it.

Economic theory predicts that in an economy where the cost of reaching mutual agreement between parties is high, and where pollution is diffuse, Pigovian taxes will be an efficient way to promote the public interest, and will lead to an improvement of the quality of life measured by the Genuine Progress Indicator and other human economic indicators, as well as higher Gross domestic product (GDP) growth.

Research on green taxation suggest that during the 1990s there was significant correlation between a country's UN Human Development Index (HDI) rank per fixed amount of GDP, and its level of green tax as a percentage of total tax revenues. Furthermore, over periods longer than 5 years, data suggest that countries having higher green tax rates such as Norway, Sweden and Netherlands experience higher GDP growth and higher HDI growth rate.

Negative tax (subsidy)

There also exists the concept of a subsidy, which can be considered a "negative Pigovian tax", to encourage certain behaviors with positive externalities (such as, say, starting a business in an underdeveloped area).

See also

References

- N. Gregory Mankiw: Principles of Economics, Second edition, Harcourt College Publishers, 2001, page 216.de:Pigou-Steuer