Financial audit

|

|

| Contents |

Basic definition

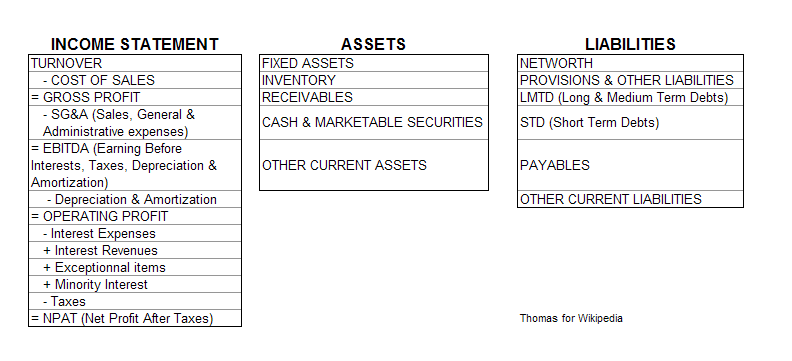

A financial audit is the examination of financial records and reports of a company, in order to verify that the figures in the financial reports are relevant, accurate, and complete. The general focus is on making sure that all assets and liabilities are properly recorded on the balance sheet, that the statement of income and expenses is correct.

Doing a financial audit is called the "attest" function. The general purpose is for an independent party (the CPA firm) to provide written assurance (the audit report) that financial reports are "fairly presented in conformity with generally accepted accounting principals."

Because of major accounting scandals (failure by CPA firms to detect widespread fraud), assessing internal control procedures have increased in magnitude as a part of financial audits.

Financial audits are typically done by external auditors (CPA firms). Many organizations, including most very large organizations, also employ (or hire) internal auditors, who do not attest to financial reports. (Internal auditors often assist external auditors, and, in theory, since both do internal control work, their efforts should be coordinated.)

History

Prior to the 1930s, corporations were required neither to submit annual reports to government agencies or shareholders nor to have such reports audited. In the United States, the 1934 Securities and Exchange Act required all publicly traded companies to disclosure certain financial information, and that financial information be audited. The establishment of the Securities and Exchange Commission (SEC) created a body to enforce the audit requirements.

In the United States, the SEC has generally deferred to the accounting industry (acting through various organizations throughout the years) as to the accounting standards for finanical reporting, and the U.S. Congress has deferred to the SEC. Accordingly, financial auditing standards (and what financial audits accomplish) has tended to change (and increase) only after auditing failures.

- 2001 : Enron case. The company succeeded in hiding some important facts, such as off-book liabilities, from banks and shareholders. Eventually, Enron filed for bankruptcy, and (as of 2005) is in the process of being dissolved. One result of this scandal was that Arthur Andersen, then one of the largest five CPA firms, worldwide, went out of business and was dissolved.

Steps

Main elements of the accounts to be audited

Audit is usually done annually through 3 main steps.

Interim review

This is the first approach of the company. It usually occurs in the middle of the financial year. For instance, a company closes its accounts yearly on December 31st. The interim audit will start in June, covering the first half of the fiscal year.

The purpose is

- to understand the business of the company, its market, what its main issues are

- to figure out what risks are from an audit point of view. This means, auditors will have to find what kind of mistake (on purpose or not) could be done in this company. For instance, if the income of sales representatives is directly linked to the sales they generate (it's of course never the case), they could try to overstate their figures, leading to an abnormally high income.

- to assess the internal control procedures actually in place. This is an important step as it will allow later to determine if one should carry out basic or advanced investigations. Indeed, if the internal control procedures seem to be reliable, this means there is no need to check accounts further.

Hard Close

This audit precedes the closing date. For a company closing on December 31, 20xx, the Hard Close would typically occur using numbers as of November 30, 20xx. Note: some hard closes are performed using the numbers as of the preceding quarter end (i.e. in the above example as of September 30, 20xx). The purpose is to audit all movements year to date.

This audit step is not mandatory, but is generally performed on larger companies to reduce the amount of time spent on the audit during Final.

Final

This is the latest step of the audit, usually some weeks after the closing. For a company closing on December 31, 2000, the Final would occur on January 30, 2001. Thanks to the work already done during the Hard Close, only the remaining range between the date of the Hard Close and the closing has to be audited.

Main tests for each process

- CASH

- Bank reconciliation : Analysis of the amounts that are written in the books but not in the bank statements and conversely. The purpose is to be able to explain each difference between books and bank statements. Usually, as the audit occurs some months or weeks after the closing date, auditors get the last bank statements to check that discrepancies have disappeared. Above all the purpose is to check that revenues written only in the books are now in bank statements (which could mean that receivables have been indeed collected).

- Circularization : To ensure that the amount for each bank account specified in the trial balance are right, auditors send a request to every bank of the company to get the current balance at the closing date. Banks usually mention the debts incurred by the company, current guarantees and people who have the power to transfer fund to and from the bank accounts.

- Financial interests : The purpose is to endorse the amount of financial interest charges and revenues. Usually, auditors perform a global test by calculating the average interest rate and the credit and debit balance throughout the year.

- Marketable securities : Auditors calculate that the gains and losses from purchase and sale of marketable securities are relevant.

- Petty cash inventory : Auditors just count the petty cash.

- EQUITY

- Table of the variation of equities : This means explaining the variation of the equity, reserve and retained earnings mainly.

- Legal documents : Check that the legal documentation reflects properly changes in equity.

- RECEIVABLES

- Debtors Circularisation : Auditors select a sample of the largest debtors (using statistical sampling software) and send letters to those debtors requesting that they agree or disagree the balance, with an explanation. Due to some customers being disinclined to respond to such letters, especially where elements of balances are in dispute, this testing is generally combined with a review of cash receipts after the balance sheet date - in order to provide more substantive evidence that the balance sheet debtors figure is accurate.

- Review of the Bad Debt Provision : Auditors review the provision made by the customer against debtors for amounts unlikely to be recoverable, and discuss any significant balances with accounting staff. This is combined with a review of an aged version of the accounts receivable ledger to identify accounts/invoices which are significantly overdue. Where overdue amounts are not included in the bad and doubtful debt provision, the auditors will seek evidence that those debts are recoverable.

- PAYABLES

- Supplier Statement Reconciliation : Auditors select a sample of suppliers and request a statement of the outstanding invoices and credit notes from each. These statements are then reconciled to the accounts payable ledgers maintained by the firm being audited, and any reconciling items investigated.

- DEBTS

- OVERHEADS

- FIXED ASSET

- TAXES

- INTERCOMPANY OPERATIONS

- PAYROLL

- PROVISION FOR RISKS AND CHARGES

- STOCK

- FINANCIAL RESULTS

- EXCEPTIONNAL ITEMS

- OTHER

- MARGIN

- BALANCE SHEET REVIEW

- CONSOLIDATION

Stakes

Audit has some specificities throughout the world but has some mains components. One of the main problem in audit is the conflict between the need to control a company and the business relationship. On one hand, the audit company has to thoroughly check the books, but on the other side, it has to keep its customer that is its source of revenue. In practical terms, this means that the audit company will try to protect itself by carrying out the minimum checks, but if it has a slight doubt, it won't go further if the client is a bit reluctant to give out information. The power of the auditor is limited by its appeal for revenues.

Biggest audit companies (often called Fat or Big Four)

Differences in terminology - US GAAP vs UK GAAP

Whilst the format of financial statements is roughly the same in the US and Europe, there are some differences in the accounting terms used.

The table below highlights some of the common ones:

| US accounting term | UK accounting term |

|---|---|

| Facilities or Fixed Assets | Fixed Assets |

| Inventory | Stock |

| Receivables / Accounts Receivable | Debtors / Sales Ledger |

| Payables / Accounts Payable | Creditors / Purchase Ledger |

| Stockholders' Equity or Shareholders' Equity | Shareholders' Funds |

| Income Statement | Profit and Loss Account |

| Revenue | Turnover |