Automated Clearing House

|

|

The Automated Clearing House (ACH) is a nationwide mechanism that processes large volumes of electronically originated batches of credit and debit transactions. Rules and regulation governing ACH is established by the National Automated Clearing House Association (NACHA) and the Federal Reserve (Fed).

ACH credit transfers include direct deposit payroll payments and payments to contractors and vendors. ACH debit transfers include consumer payments on insurance premiums, mortgage loans, and other kinds of bills.

Debit transfers also include new applications such as the Point-of-Purchase (POP) check conversion pilot program sponsored by NACHA. FedACH is the Federal Reserve's centralized application software used to process ACH transactions. Both the government and the commercial sectors use ACH payments.

The Federal Reserve Banks are collectively the nation's largest automated clearinghouse operator and in 2000 processed more than 80 percent of commercial interbank ACH transactions. Private-sector ACH operators (PSOs) process the remaining transactions and typically provide services, including processing and settling ACH transactions, similar to those offered by the Reserve Banks. PSOs and the Reserve Banks rely on each other for the processing of some transactions in which either the Originating Depository Financial Institution (ODFI) or Receiving Depository Financial Institution (RDFI) is not their customer. These interoperator transactions are settled by the Reserve Banks.

In 2002 the system processed more than 8.94 billion ACH entries which amounted more than $24.4 trillion.

| Contents [hide] |

Uses of the ACH Payment System

- Direct Deposit of payroll, Social Security and other government benefits, and tax refunds

- Direct Payment of consumer bills such as mortgages, loans, utility bills and insurance premiums

- Business-to-business payments

- E-checks

- E-commerce payments

- Federal, state and local tax payments

ACH process

It is important to note that in accordance to the rules and regulation of ACH, no financial institution may simply issue an ACH transaction (whether it be debit or credit) towards an account without prior authorization from the account holder (known as the Receiver in ACH terminology).

An ACH entry starts with a Receiver authorizing an Originator to issue ACH debit or credit to an account. An Originator can be a person, the gas company, your local cable company, or your employer. Depending on the ACH transaction, the Originator must receive written (ARC, POP, PPD), verbal (TEL), or electronic (WEB) authorization from the Receiver.

Once authorization is acquired, the Originator then creates an ACH entry to be given to an Originating Depository Financial Institution (ODFI), who can be any financial institution who does ACH origination. This ACH entry is then sent to an ACH Operator (usually the FED) and is passed on to the Receiving Depository Financial Institution (RDFI), where the Receiver's account is issued either a credit or debit depending on the ACH transaction.

The RDFI however may reject the ACH transaction and return it to the ODFI with the appropriate reason, such as there was insufficient funds in the account or the account holder said the transaction was unauthorized. An RDFI has a prescribed amount of time to perform returns, ranging from 2 to 60 days from the receipt of the ACH transaction.

ODFI's receiving a return of their ACH entry may re-present the ACH entry one more time for settlement. Again, the RDFI may reject the transaction. After which, the ODFI may no longer represent the transaction via ACH.

Standard entry class code

The Standard Entry Class (SEC) code is a three letter code that identifies the nature of the ACH entry. Here are some common SEC codes:

ARC Accounts Receivable Entries. Checks received by a merchant through mail or drop box and are presented as an ACH entry.

CCD Corporate Cash Disbursement.

DNE Death Notification Entry. Issued by the Federal Government.

POP Point-of-Purchase. A check presented in-person to a merchant for purchase is presented as an ACH entry instead of a physical check.

PPD Prearranged Payment and Deposits. Used to credit an account. Popularly used for payroll direct deposits.

RCK Represented Check Entries. A physical check that was presented and was returned because of insufficient fund may be represented as an ACH entry.

TEL Telephone Initiated-Entry. Verbal authorization by telephone to issue an ACH entry such as checks by phone.

WEB Web Initiated-Entry. Electronic authorization through the Internet to create an ACH entry such as PayPal.

XCK Destroyed Check Entry. A physical check that was destroyed because of a disaster can be presented as an ACH entry.

Some issues with ACH

ACH has been around for sometime now, but people are just getting used to them. Especially with the ARC, POP, and RCK, where the original instrument was a physical check. One issue is when the account holder issues a stop payment on a physical check not knowing that the check was presented as an ACH entry.

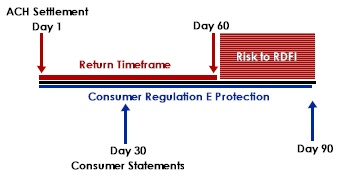

A timeframe issue can cause potential loss towards an RDFI due to irregular timeframes provided for the return of ACH entries that are subject to Regulation E. An example is a POP and ARC entry, where an RDFI has only 60 days from the date of settlement to return an unauthorized debit, and the consumer has 60 days upon notification to dispute a transaction in his statement under Regulation E. With these timeframes, it is possible for the 60-day period for ACH return expires even before the consumer's 60-day protection under Regulation E expires.

Another issue deals with compliance where the merchant had an ODFI issues an ARC or POP entry (for check presentment) and fails to comply with the handling of the physical check and presents the physical check for payment as well. This ends up with a double debit against a consumer account.

External links

- Federal Reserve Payment Systems (http://www.federalreserve.gov/paymentsys.htm)

- What is ACH? (http://www.nacha.org/About/what_is_ach_.htm)